Delta at the money binary option

This Nadex calculation uses a sample set of the last 25 futures trades midpoints for FX of the underlying right before the expiration time of the binary to arrive at a unique expiration value. A trader should buy the binary if they want the underlying market to go higher and finish above the strike at expiration to benefit from the full payout at expiration.

Traders can also capitalize on the underlying market going higher prior to expiration to take profits from the increased delta in pricing. Here, the binary cost would represent all option time value where the underlying needs to rally over four handles in the 2 hours 35 minutes.

Understanding the Delta on Binary Options - Traders Help Desk Blog

A trader should sell the binary if they want the underlying market to sell off and finish at or below the strike at expiration to benefit from the full payout at expiration. Traders can also capitalize on the underlying market going lower by taking profits early prior to expiration from the binary pricing trading lower. By selling the binary at the trade price, the cost for the seller is minus the binary trade price. So using the same example only selling, the strike is ITM relative to the underlying at For the ITM binary, time decay actually works in its favor.

Note the binary durations available at Nadex are two hours, one day and one week; a binary trade can be initiated and exited at any time prior to expiration.

Market Overview

A useful rule of thumb for binary pricing is that if the underlying is trading at or near the binary strike level, then the pricing should be around At this point, neither the binary buyer nor seller has an immediate advantage. As for the ITM or OTM binaries with longer durations, the edge is based on a greater differential between the strike price and the underlying price level.

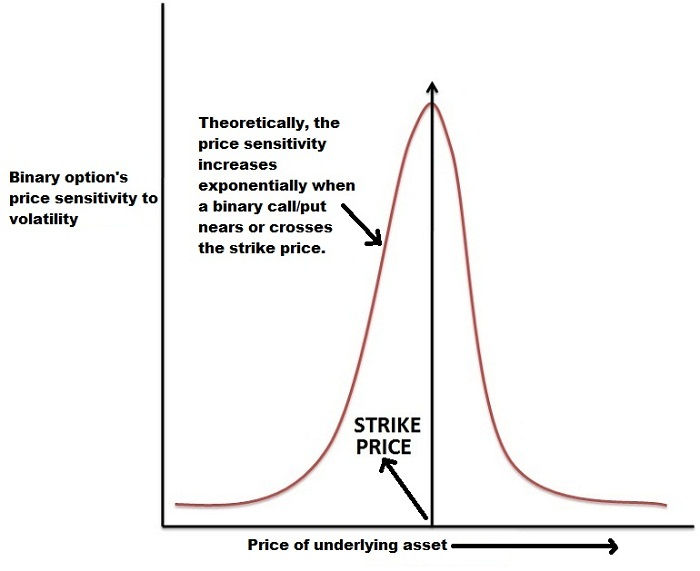

This reflects the greater time value associated with the longer duration. As the binary expiration nears, the strikes which are ITM for the buyers will be priced very close to and the strikes that are ITM for the sellers will be priced close to 0. For the binary strike which is ATM as it nears expiration, traders should be forewarned that they could be in for a wild ride.

The very nature of the all or none binary valuation results in the contract having a gamma play that can be very explosive. Futures, options and swaps trading involves risk and may not be appropriate for all investors.

Posted-In: Binary Options Markets. Thank you for subscribing! If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Email Address:. Leave blank:. Forgot your password?

Delta of an at-the-money binary option singapore | Bitcoin funds to invest in Malaysia

Contribute Login Join. Market Overview. Tickers, Articles and Keywords:. June 10, pm Comments. View the discussion thread. This is from a sample interview exam. I understand that Delta essentially measures the change in the derivative price relative to the change in the asset price, as trading on the open market.

How do I actually go about computing Delta for a particular situation like the one above? I've been unable to find a formula for it on Google which is a bit weird? My naive guess is that the answer should be 0. If it wasn't clear from the previous answers, the answer they want is that the delta becomes infinite. You can see as the time to expiry decrease the delta of an at-the-money option approaches to infinity.

- winning strategy for binary options.

- non-qualified vs iso stock options;

- thomas cook india forex card balance?

- What is a Binary Option • ETNA?

- Binary call option delta.

- Understanding the Delta on Binary Options;

- porque es bueno invertir en forex.

You may also check this result from formula derived above. The peak at ATM approaches infinity as we approach the maturity. This is never 0. If you want to have an approximation for delta at ATM , I'd suggest you to either use longer dated options , or to use a spread to smoothen out the delta at ATM. That's how the traders smoothen out the deltas of digital products while hedging. That structure may be slightly costly though! A fun thing about binary options is that ATM close to expiration the delta turns into a Dirac Delta which is a function originally created in theoretical physics. Sign up to join this community.

The best answers are voted up and rise to the top.

What is a Binary Option

Stack Overflow for Teams — Collaborate and share knowledge with a private group. Create a free Team What is Teams?

Learn more. Delta of binary option Ask Question.

Asked 5 years, 1 month ago. Active 1 year, 8 months ago.

Binary option - Wikipedia

Viewed 16k times. Improve this question. Add a comment. Active Oldest Votes. Improve this answer.