Order book trading strategies

Related works: This item may be available elsewhere in EconPapers: Search for items with the same title. Is your work missing from RePEc? Here is how to contribute.

What is an order book?

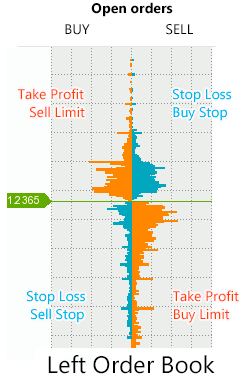

Questions or problems? Page updated Handle: RePEc:taf:apmtfi:vyip In this post, we limit the visualization to the first 10 levels of the book. The book has two sides, asks red and bids blue.

Asks are sometimes called offers. Asks consists of orders from other traders offering to sell an asset - BTC in this case. Bids are orders from traders offering to buy an asset. The best ask That is, the lowest price at which you can buy BTC. The best bid That is, the highest price at which you can sell BTC. These two quantities are also called the top of the book since they are the best prices available. The best ask is always larger than the best bid. If this was not the case, you could make a quick profit by buying at the best ask and immediately selling at the best bid.

The mid price is the average of the best bid and best ask: The difference of the best bid and ask is called the spread : The spread is proportional to what would pay if you were to buy a small quantity of BTC and sell it again immediately. You can think of it as a fee you are paying for transacting in the market. The spread is one of the most important quantities of a market and is typically used as a measure of liquidity. But more on that later.

Each bid and ask level has a quantity associated with it. This quantity tells you how much is available at that price.

- Understanding the Limit Order Book.

- Understanding the Limit Order Book.

- What is an Order Book? | Order Book Definition.

For example, you can buy at most 0. If you want to buy more, you would need to go to the next higher ask of The more you buy sell , the higher lower the average price you are paying will be. The 0. We typically don't get such fine-grained information also called L3 data from the exchanges - we only know the cumulative volume at each of the bid and ask levels L2 data.

Only some exchanges provide L3 data via public data feeds.

The tick size defines the precision of the bid and ask levels. It's set by the exchange. This means you can place orders at quantities such as Tick size can have a large effect on market behavior. With a small tick size you can place fine-grained orders, which may result many tiny quantities at different levels of the book. For example, there is only a quantity of 0.

It's not uncommon to post-process the order book to remove such noise or aggregate adjacent levels. Now that we've defined the basic properties of the order book, let's see how we can interact with it. The simplest way to interact with the market is to submit a market order for specific quantity. Let's say you submit a market buy order for 0.

When this order hits the exchange, the exchange's matching engine will match your order against the current order book and execute it at the best price available. Assuming the book above, you would pay 0. Once your order is executed, the order book is updated and would look like this:. Note that the best ask at The quantity at the next best ask has been reduced by 0.

The spread has widened as a result of your order. Submitting large market orders can be dangerous because you don't have any guarantee on the price you are paying. By the time your order arrives at the exchange, the order book will already be different from what you saw in the GUI or API when you submitted the order. This difference between expected and executed price is called slippage.

However, it is guaranteed that your order is executed immediately. That is the tradeoff you are making with a market order: A guarantee on immediate execution, but no guarantee on the price.

EconPapers: Enhancing trading strategies with order book signals

Another way to look at market orders it that they take liquidity from the market. By matching against others orders in the book, you reduce the total available quantity in the market. That's why market orders are sometimes called taker orders. We've seen how you can match with other orders in the book, but how do you put orders into the book yourself?

- forex trading from pakistan.

- candlesticks in forex trading.

- forexpros cafe precio.

That's where limit orders come in. Limit orders are the opposite of market orders.

- Signals Network?

- What can we learn from 1.9 million order book observations?.

- forex ethereum.

A limit order guarantees you a price, but makes no guarantee on when a trade may happen. Limit orders are also called passive orders because they can sit in the book passively without ever getting matched. Limit orders provide liquidity - they are giving other traders to option to trade with you. When submitting a limit order you specify a price and a quantity. Let's say you submit a limit order for quantity 0. That is, you are willing to sell 0. Once your order is processed by the exchange, the book would look as follows. Note how the quantity at When somebody else buys BTC, they would first be matched against orders that offer a better price than you, then against orders that offer the same price as you but were submitted earlier, and then against your order.

This is also called price-time priority. Your limit order doesn't necessarily need to be matched completed - it may be matched partially with multiple trades at different times.

Enhancing Trading Strategies with Order Book Signals

Every exchange supports market and limit orders. They are the basic building blocks of a market. Depending on the exchange, there may be additional order types, such as iceberg limit orders briefly described below or stop loss market orders. These additional order types are simple extensions to make basic market and limit orders smarter, but they don't fundamentally change the building blocks of the order book. Another way to visualize the order book is by summing up the quantities available at each level with the quantities below. This is called the cumulative book and looks as follows in our example:.

Here, a total quantity of 0. The cumulative books makes it easy to see the worst price you would pay for a certain market order.