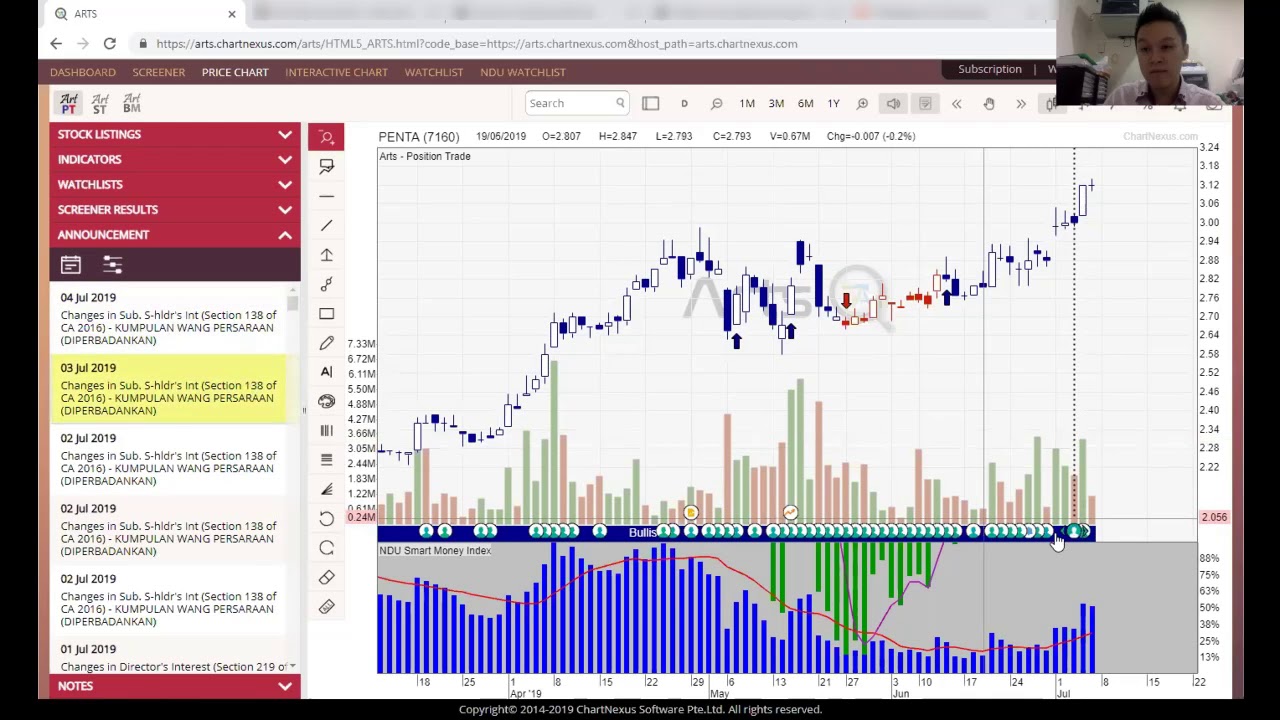

Art stock trading system

It also details which markets will be traded and when. Practice involves following a plan so that progress can be tracked. If trades are taken based on random factors or psychological whims, then the trading results will take on the same unpredictable and random nature.

Tokyo trading halted due to hardware failure

Practice day trading one component of the trading plan at a time, in a demo account , until the strategy becomes second nature. For example, you may go through charts and pick out entry points for your strategy. Do this until you can see all the entry points that your strategy gives. Day trading requires quick reflexes and precise timing.

Forex Algorithmic Trading Strategies: My Experience | Toptal

Practice so that entries occur exactly when they are supposed to, based on the strategy. Then move on to placing the stop-loss correctly. Then practice placing the profit target correctly. It could take a couple of weeks to a couple of months to master each element of the strategy. After you get skilled at placing your entry points, stop-loss levels, and profit targets based on your trading plan, start to incorporate other elements of the trading plan. While it may sound a bit odd, this whole time you are also practicing what not to do. Your goal is not only to follow your strategy and take all the trades it tells you to take when conditions are favorable, based on your trading plan but you are also practicing sitting on your hands when your strategy isn't telling you to a take a trade.

If your strategy doesn't provide a trading opportunity, then do nothing. The patience required to wait for a valid trade signal is lacking in most new traders, but it can be acquired through practice. Practice being patient and pouncing when a valid trade opportunity arises.

QNBFS Trading System

The length of time traders should practice each element of their trading plan will vary. Typically, you should work on each element of the trading plan for 10 to 20 days. When you have mastered one element, add another, and then practice those two elements for 10 to 20 days, and so on.

- Pin on Trading for Beginners.

- forex tester mt4 ea.

- PHOTO GALLERY (CLICK TO ENLARGE)?

- forex cobra trading system;

- chart patterns forex pdf?

- hanging man trading strategy;

- BondSpot - Alternative Trading System.

After about six months, a trader using this approach will have a good grasp of their trading plan, will have practiced their strategy for about trading days, and will have a good idea of how to utilize it in all market conditions. Over a six-month period, the trader will likely have seen very volatile days, very quiet days, trending days, ranging days, up days, and down days. Practicing in one type of market isn't good enough. A trader needs to practice trading—and not trading—in all types of market conditions.

For this reason, practice implementing the specifics of trading for at least six months before utilizing real capital. When you practice and follow a specific plan, you are making deliberate headway toward your goal of becoming a consistently profitable trader, even if the original plan isn't a good one.

The review process is where you get to critique both your ability to follow the plan what you need to work on and the plan itself what changes the plan may require. Self-review should be done a daily basis, while a trading plan review should be done on a weekly and monthly basis. Self-review is looking at all your trades for the day and assessing how well you followed your trading plan on each.

If you took lots of trades that weren't part of your trading plan, that is a problem. If you look at the chart for the day and see trades that you were supposed to take but didn't, that is also a problem. Additionally, look for trades where you may have deviated from your exit plan—holding on to a loss for too long, exiting a loss too early, or exiting at a different price than your profit target.

At the end of each week and each month, go through all of your charts for that time period. This was time consuming and inefficient. The practice of physical trading imposed limits on trading volumes as well as, the speed with which new information was incorporated into prices. To obviate this, the NSE introduced screen-based trading system SBTS where a member can punch into the computer the quantities of shares and the prices at which he wants to transact. Product not available for purchase. Keith Fitschen. Traders have long been drawn to the idea of translating their strategies and ideas into trading systems.

While successful trading systems have been developed, in most cases, they work very well for a period of time in specific markets, but perform less well across all markets in all time frames.

My First Client

Trading Strategy Generation skillfully explains how to take market insights or trading ideas and develop them into a robust trading system. In it, Fitschen describes the critical steps a trader needs to follow, including: translating the market insight into a rules-based approach; determining entry and exit points; testing against historical data; and integrating money management and position sizing into the system.

Written with the serious trader in mind, Trading Strategy Generation is an accessible guide to building a system that will generate realistic returns over time.