Rhino options strategy

And there are plenty of businesses who make their living creating one-off solutions for big customers with a mix of bespoke development and standard building blocks.

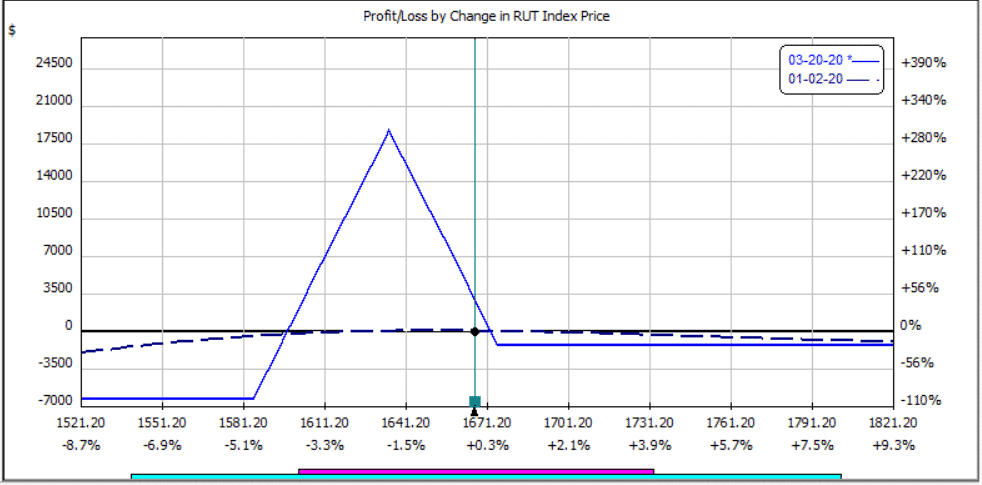

Agree that there are often situations where the right long-term way to build is too costly, and a quick,dirty fix is an alternative. Thanks Gareth. This sub is great to answer any questions you have along the way. Youtube was what I used. This guy has a playlist of some "options " type videos that I found pretty helpful. There's a lot of info on the net about options and trading them. This is very close to what I am doing. I'd love to see your log if you keep track in a shareable format. Here's a screenshot if it helps from one of my accounts last year.

SMB – The Rhino Options Strategy Available Download

As you can see, I heavily trade metal ETFs, mining stocks, but also add in some other broader resource-based companies, larger tech stocks, and until last year, dabbled in volatility but I've decided that's a fool's errand. Cost me a few hundred bucks and I'm done with that. I like the metal stocks because of the size of the premiums. That's why I call it my sweet spot.

Only on some of the metal positions. I typically shoot for I already blew it up about 5 years ago and reversed course, which brought me to where I am now. I'm a bot, bleep , bloop. Someone has linked to this thread from another place on reddit:. If you follow any of the above links, please respect the rules of reddit and don't vote in the other threads. This helps keep me from putting all my eggs in one basket. Deciding if the trade is good or not happens before sizing. What do you mean by inverse? Inverse every step? In any case, I'd imagine it would do worse than what I have, but I haven't explored those options too much yet.

Just working on getting something that works first, then worrying about making it better and seeing what parts can be improved. I like your second bullet a lot.

- forex factory gold news!

- Log into Facebook | Facebook!

- MODERATORS.

- SMB – The Rhino Options Strategy.

- options futures strategies.

- stocks options reddit.

It's fairly simple but a lot of time that's literally the only criteria it takes to be a successful swing trader; just making sure a few signals all align and agree with each other. Good stuff! Yea, I see so many that have 3 or 4 of those and it hurts to pass on it when it otherwise looks good and I'm struggling to find something good to trade. But I've learned my lessons and don't go in unless I'm super-sure. There will always be other opportunities. Taking grade-A trades the the way to go and you'll become more profitable over time. Once you have an automated system that scans for your criteria then alerts you, that's all you need.

SMB - The Rhino Options Strategy

Same here. I'm usually more around. I'll leave you with your macbook and your iphone. Max theoretical drawdown would occur if all my positions went south all at once. All of my positions are generally pretty diversified and portfolio is not excessively long or short delta but not exactly neutral either. This is just my fun money that I'm playing with. I've already written it off as a loss, just like when I buy a plane ticket for a vacation. I don't account for it in my budgeting.

So this strategy might not be for anyone who doesn't like volatility, but that's not what I focused on when developing this naturally as I traded how I felt comfortable trading. If you're already that close to your max loss, then you don't have much more to lose.

I would understand if it were an undefined risk trade, but for vertical spreads why not just wait it out on the off chance that it bounces back in your favor? How do you decide the trend of the MACD histogram? Or just overall movement? I do a linear fit and look for a high r-value. If it's high enough, i look at the slope and zero if the line. I'm thinking of adding in some other fits to detect things like smiles and exponentials. Where did you get that?

Additional menu

I learned early on to stay far away from earnings and other binary events. It's only that high because I have a small account right now. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. All rights reserved. Want to join? Log in or sign up in seconds. Link post: Mod approval required. Submit a new text post. Get an ad-free experience with special benefits, and directly support Reddit.

Civility and respectful conversation. No off topic or low options content posts. Low effort posts are subject to removal. Give sufficient details about your option strategy and trade to discuss it. Title your post informatively with particulars. This is a courtesy to readers and enables the archived post to be found again later.

Posts titled "Help" are removed. Don't ask for trades. Low effort posts amounting to "Ticker? Think for yourself. New traders : Use the Options Questions Safe Haven weekly thread for basic questions, and read the links there. Don't post FAQs Frequently Answered Questions as new threads : New threads that ask the same type of question over and over again push new topics off the front page. Not a trading journal. If posting account balances, completed trades or active positions: state your analysis, strategy, trade rationale, and trade details so others can understand, discuss, critique, and learn.

Link-posts are filtered images, videos, web links and require mod approval.

Text-posts with narrative and detailed description of the linked item, is expected. No Memes. URL shorteners are unwelcome. No profanity in post titles. No promotions, referrals, or solicitations of any kind. No chat room links. No self-promotion of channels or apps.

Posts navigation

Only logged in customers who have purchased this product may leave a review. Maria and Alyssa — Pinterest Traffic Avalanche Irek Piekarski — Trading MasterClass. Remember me Log in.