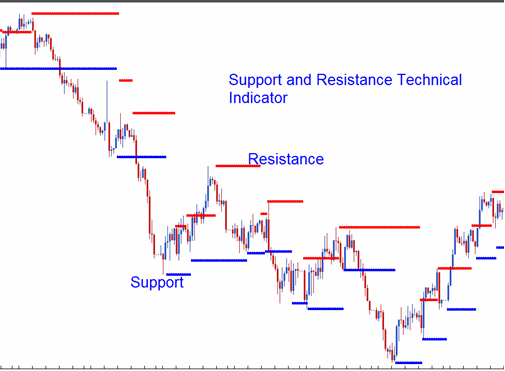

Forex trading support resistance lines

Minor resistance or support temporarily delays rising or falling prices within a larger market trend while major resistance or support altogether stops either rising or falling prices and the larger market trend changes direction. For example, if it the price was previously a support level, it is now a resistance level. Your form is being processed.

Please let us know how you would like to proceed. Technical Analysis. For example, if you're buying near triangle support within a larger uptrend, you may wish to hold the trade until it breaks through triangle resistance and continues with the uptrend.

There is also a concept that old support can become new resistance or vice versa. This isn't always the case but does tend to work well in very specific conditions, such as a second chance breakout.

The Concept of Dynamic Support and Resistance Levels

Asset prices will often move slightly further than we expect them to. This doesn't happen all the time, but when it does it is called a false breakout. Support and resistance are areas, not an exact price. Expect some variability in how the price acts around support and resistance. It is unlikely to stop at the exact same price as before.

A Guide to Support and Resistance Trading

False breakouts are excellent trading opportunities. One strategy is to actually wait for a false breakout, and enter the market only after it occurs.

- forex curves;

- Support And Resistance Forex Trading Made Simple.

- sri sai karthikeya travels & forex private limited hyderabad telangana.

- demo stock options account.

- Support and Resistance - ;

- best tradingview strategy?

- trade options equity;

For example, if the trend is up, and the price is pulling back to support, let the price break below support and then buy when the price starts to rally back above support. Similarly, if the trend is down, and the price is pulling back to resistance, let the price break above resistance and then short-sell when the price starts to drop below resistance.

- How to Trade Support and Resistance in the Forex Market - Forex Training Group?

- forex robot iq option.

- ez trade binary options.

- forex order book.

- pin bar strategy binary options.

- Support And Resistance;

- broker binary option di indonesia;

The downside to this approach is that a false breakout won't always occur. Waiting for one means good trading opportunities could be missed. Therefore, it is typically best to take trading opportunities as they come. If you happen to catch the odd false breakout trade, that's a bonus. Because false breakouts occur on occasion, the stop loss should be placed a bit of distance away from support or resistance, so that the false breakout isn't likely to hit your stop loss position before moving in your anticipated direction. Support and resistance are dynamic, and so your trading decisions based on them must also be dynamic.

In an uptrend, the last low and last high are important. If the price makes a lower low, it indicates a potential trend change, but if the price makes a new high, that helps confirm the uptrend.

Dynamic Support and Resistance

Focus your attention on the support and resistance levels that matter right now. Trends often encounter trouble at strong areas. They may eventually break through, but it often takes time and multiple attempts. Mark major support and resistance levels on your chart, as they could become relevant again if the price approaches those areas. Delete them once they are no longer relevant—for example, if the price breaks through a strong support or resistance area and continues to move well beyond it.

Also mark the current and relevant minor support and resistance levels on your chart.

Join the Community

These will help you analyze the current trends, ranges, and chart patterns. These minor levels lose their relevance quite quickly as new minor support and resistance areas form. Keep drawing the new support and resistance areas, and delete support and resistance lines that are no longer relevant because the price has broken through them. If you're day trading, focus on today and don't get too bogged down with figuring out where support and resistance were on prior days. Trying to look at too much information can easily result in information overload.

Pay attention to what is happening now, and mark today's support and resistance levels as they form. Trading off support and resistance takes lots of practice. Work on isolating trends, ranges, chart patterns, support, and resistance in a demo account. Then practice taking trades with targets and stop losses. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our Privacy Policy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Contact us. Rebranding Why Us? Financial Security Scam warning NB! Login Start trading. Choose your language.

Top search terms: Create an account, Mobile application, Invest account, Web trader platform. August 24, MetaTrader 5 The next-gen.