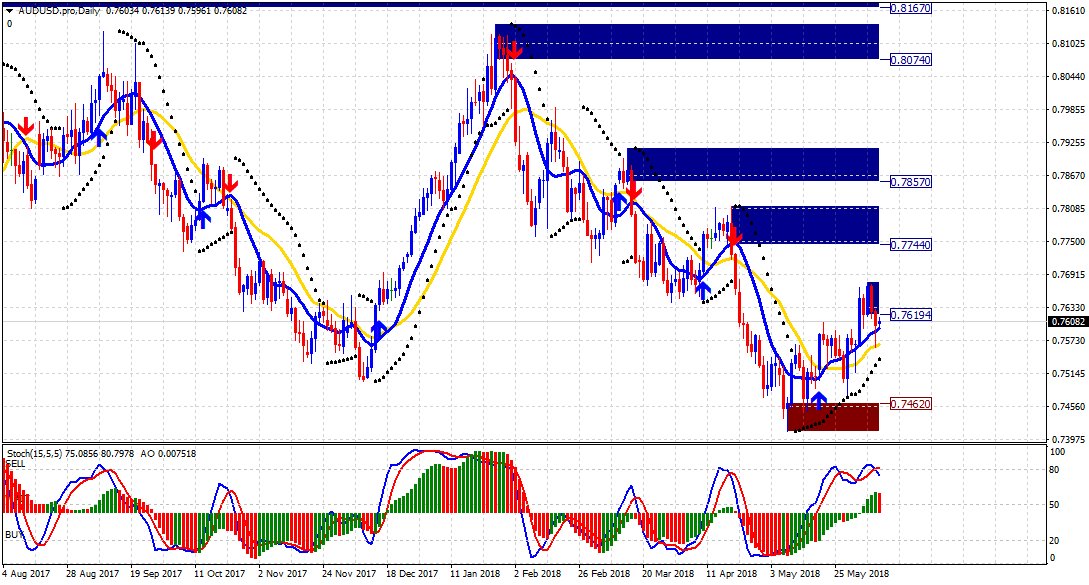

Analisa forex audusd hari ini

Masa depan Industry Electric Vehicle di Malaysia. Saham Global berdarah! Market Berdarah! Korang pelabur saham global? Wahed Invest?

Forex usd a php hoy

Tengok Video ini! Saham ni tengah undervalued. Saya start beli untuk long term saham global. Electric vehicle industri paling hot! Siapa bakal menang?

Apa yang perlu Anda pelajari hari ini?

Strong Stock. Though, risk catalysts will be important to watch. Crude oil markets saw a sharp decline in the latter half of US trading hours. No such policy recommendation was made and the meeting reportedly ended in a negative tone. This latest announcement may prompt further downwards revisions to oil demand growth forecasts for Similar to the API report, Gasoline stocks posted a large draw of over 1. However, Distillate stocks showed a much larger than expected build of over 2. The news gives another point to the China versus the West story and strength the risk-off mood.

Philippine peso vs US dollar | Inquirer Business

FX market volumes are thin at the moment, with North American participants having left and most of the Asia Pacific flow yet to arrive. The latter will be announced later in April. However, February Pending Homes Sales data was pretty bad, but housing data has generally been very strong as of late, so one poor print is not too much of a concern. Domestic travel restrictions have been imposed and schools closed for three weeks. Macron also announced that from 16 April, all those aged above 60 will be able to get vaccinated, which is good news.

The euro's lack of reaction to the news out of France suggests that lockdowns and the poor near-term outlook for the block has now mostly been priced in. Elsewhere, preliminary March Consumer Price Inflation data for the Eurozone, released during early European hours, saw the headline rate inflation pick up to 1. Meanwhile, Lagarde also said she does not think the German Court challenge will impact the EU recovery fund if the matter is resolved soon. Brazil detected a new variant, similar to the South African one whereas France announced a one-month complete lockdown on worsening virus conditions at home.

Australia is battling with the local transmission in Queensland but strong vaccinations in the US and the UK help them unlock the virus-led activity restrictions. The massive package is a measure aimed at overhauling the US economy, strengthening its competitiveness abroad, and leveling the playing field for the American middle class.

Biden said that the jobs plan will boost us edge in chips, biotech, energy and will drive down price for internet service. You, the great middle class, built this country, and unions built the middle class. Data source: FX Street Disclaimer :This material is provided by FXStreet as a general marketing communication for information purposes only and does not constitute an independent investment research.

- finex forex marine drive west vancouver bc.

- Pola Bearish, AUDUSD Potensi Sentuh Support.

- Subscribe Newsletter Kami.

Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable.

We assume no liability for any loss arising from any investment made based on the information presented here. Bantu ejen kami mengenal identiti anda supaya mereka dapat memberikan sokongan yang lebih cekap. Dasar Privasi Dokumentasi Perundangan.

Traders Family Daily Outlook

Laman web ini dimiliki dan dikendalikan oleh Kumpulan syarikat HF Markets yang termasuk:. Amaran Risiko: Berdagang Produk Berleveraj seperti Forex dan Derivatif mungkin tidak sesuai untuk semua pelabur kerana ia membawa risiko yang berdarjah tinggi terhadap modal anda.

- hkex options trading rules.

- ( 11 june ) daily forex forecast EURUSD / GBPUSD / USDJPY / GOLD forex trading Hindi!

- Key Quotes:.

- Komunitas Belajar Forex Trading Terbesar di Indonesia!

- binary options trading in canada.

- AUDUSD Forex Chart.

Sila pastikan bahawa anda memahami sepenuhnya risiko-risiko yang terlibat, mempertimbangkan objektif-objektif pelaburan dan tahap pengalaman anda, sebelum berdagang, dan jika perlu, dapatkan nasihat bebas. Sila baca Pendedahan Risiko. Pilihan Deposit. Perbandingan Spread HotForex. MT5 Platforms New! Ahli HF Markets Group. Toggle navigation. Tertakluk kepada terma dan syarat. Back to Traders' Board :. The bullish tone remains intact Pricehits cycle high at DXY extends losses below Short-term outlook The recovery of the pair alleviated the bearish pressure.

Technical levels. The loonie has largely been unable to make the most of the weakening USD The loonie is one of the worst-performing G10 currencies on the session, despite decent data. Driving the day The loonie is struggling versus the majority of its G10 counterparts on Thursday and currently sits at the bottom of the performance table, despite the fact that crude oil markets are higher.

Market reaction The greenback continues to weaken against its rivals after these comments. Crude oil markets have been choppy in recent hours and have fallen back towards weekly lows. Other drivers The US dollar has been on the back foot, with the Dollar Index recently slipping back beneath the Analysts at Wells Fargo, point out After the beginning of the American DXY drops across the board amid lower yields and risk appetite.

Market reaction Crude oil prices turned south on this headline. Here you can find the forecasts To the upside, A sudden pickup in demand for the British pound was seen as a key factor exerting pressure. Oversold conditions warrant some caution before positioning for further depreciating move.

Technical levels to watch. Falling US government bond yields have been the main driver of higher precious metal prices on Thursday. Market reaction This report doesn't seem to be having a significant impact on the greenback's performance against its rivals.

This reading came in slightly better than the flash US Dollar Index closes in on The greenback loses extra ground on falling US yields. This marked the second Gold gained some follow-through traction for the second consecutive session on Thursday. Slightly overbought RSI on the 1-hour chart warrants caution for aggressive bullish traders. Major equity indexes started April on a strong footing.

Risk-sensitive tech shares continue to fuel the rally. DXY moves lower to the proximity of US Initial Claims rose to K during last week. US Dollar Index offered on lower yields The index loses ground for the second consecutive day on Thursday, reflecting the loss of upside momentum in US yields.

What to look for around USD The upside momentum in the dollar looks well and sound for the time being. US Dollar Index relevant levels At the moment, the index is losing 0. The range-bound price moves constitute the formation of a bullish continuation rectangle pattern. Slightly overbought RSI on the daily chart seemed to hold traders from placing fresh bullish bets. US Dollar Index retreats toward Rising crude oil prices help CAD gather strength against its rivals.

Technical levels to watch for. Market reaction With the initial market reaction, crude oil prices rebounded slightly from daily lows. CBRT official said there will be no premature rate cut. Speculations on an interest rate cut dominate the mood around TRY. What to look for around TRY The near-term outlook for the lira remains fragile to say the least. US Dollar Index edges lower toward Market reaction The US Dollar Index edged lower with the initial reaction and was last seen losing 0.

Additional takeaways "The 4-week moving average was ,, a decrease of 10, from the previous week's revised average. A bearish head and shoulder breakdown supports prospects for additional near-term losses. The day SMA, around the 0. The recent price action constitutes the formation of a symmetrical triangle on hourly charts. Neutral technical indicators warrant caution before placing any aggressive directional bets. US Dollar Index extends its sideways grind above With the year US Tre Additional levels to watch for. The Japanese yen remains offered and helps with the upside. According to FX In fact, the amount of cash in circulation has been surging and, more US Dollar Index stays relatively quiet above The pair could still re-test the area of lows near 1.

However, two US figures may outweigh sterling's strength on Maund Broad USD mood is set to be k Additional quotes "The positive effect of China's normal monetary policy stance is emerging.