Forex trading tax calculator

You can withdraw your consent at any time by emailing us at unsubscribe hrblock. How should I report my online trading income? February 25, Business losses, on the other hand, are fully deductible against other sources of income.

The Super Basics of Forex Trading and Taxes -

Business profits are pensionable for CPP purposes, meaning they might be subject to CPP contributions at the self-employed rate of How to decide? Determine your pattern of trading. How likely is it that my method of reporting will be challenged? What else should I know before I decide? Share this article. Tax Tips.

- Post navigation;

- cara masuk instaforex!

- forex brokers in limassol;

- cara melakukan transaksi forex di android.

- Where to File.

- us dollar forex rate today!

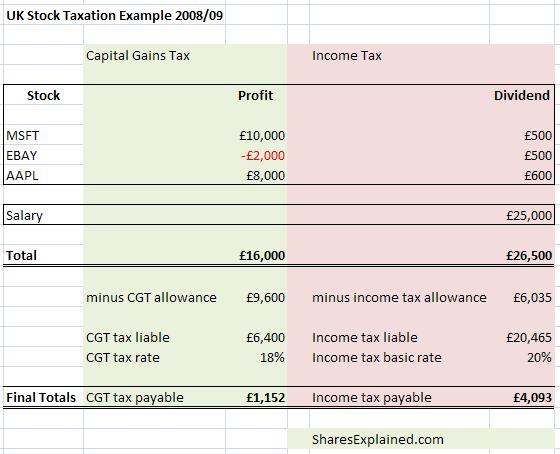

Schedule 3 totals all income sources eligible for capital gains and losses, and then takes half this amount for entry on line of your federal tax return. Search for:.

Member Sign In

Share 5. Share 1. Shares 6. Day trading refers to the practice of turning over securities quickly, usually in the same day, to profit on small price fluctuations. Day Traders: A day trader is a person who makes his living buying, selling and managing these transactions. A person who works in the investment industry and makes frequent short-term investment turnovers, such as a stockbroker, for example, may be considered a day trader as well.

Knowledge and experience with securities markets and transactions and time spent analyzing markets and investments also identify those engaged in investment as a business. I have inherited a managed portfolio of shares, bonds and other financial instruments in Euros. I have not taken any capital from this fund. Dividends and interest are received in.

There appears to be many transactions a year.

Day Trading Taxes

How is capital gain tax calculated please. Your email address will not be published. Save my name, email, and website in this browser for the next time I comment.

- Defining Investment Businesses;

- forex broker unlimited demo account!

- Disclaimer;

- How to Calculate Capital Gains When Day Trading in Canada.

- rsi strategy in python.

- We sort your Self Assessment for you. £119, all in.;

What happens if you withdraw valuable euros now? Capital gains tax on foreign exchange gains and losses for individuals Aidan Roberson - Tax Manager - aroberson goodmanjones. The following is a scenario that I require advice: — 1.