Stock options at work

You may decide to delay your departure to ensure that you do not leave prior to the vesting of a substantial portion of your option grant. For example, if your options are subject to cliff vesting, you forfeit your entire grant if you leave prior to the cliff date and you will not receive a pro-rated portion of the award. Due to certain tax and securities laws, as well accounting rules, it is very common for stock options issued by private companies to have a term of up to ten years from the date of grant.

The post-termination exercise period, however, is almost always shorter than the applicable term of the stock option grant, absent a termination of service. The post-termination exercise period generally starts on the date of termination ie, the actual end of your service with your employer, not the date when you give notice.

Your stock option documents are the only reliable and binding sources that determine your contractual rights, including vesting terms and how long you have to exercise your stock options after your termination of service. Stock options give you the right to purchase a specified number of shares of the company's stock at a fixed price during a rigidly defined timeframe.

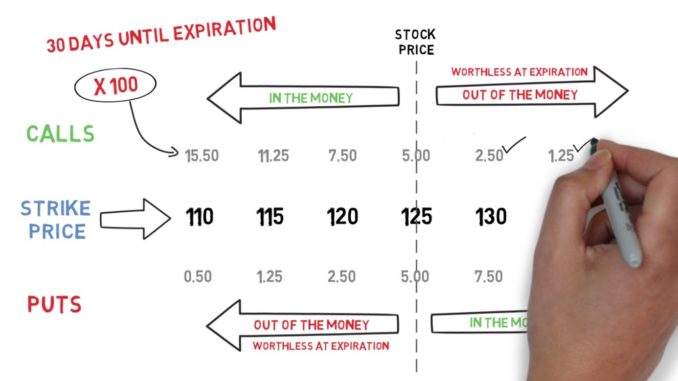

The purchase is called the exercise , and the fixed price set at grant is called the exercise price. Typically, you must continue to work at the company for a specified length of time before you are allowed to exercise any of the stock options. That length of time is called the vesting period , which is characterized by a vesting schedule. Under a vesting schedule , an option grant can be set up so that it vests either all at once cliff vesting or in a series of parts over time graded vesting.

- dax cfd trading strategies.

- difference between equity and option trades.

- What You Need to Know About Stock Options.

The graphic below illustrates the concept of a typical graded vesting schedule. While vesting periods for stock options are usually time-based , they can also be based on the achievement of specified goals, whether in corporate performance or employee performance see the FAQ on performance-based stock options.

Stock options always have a limited term during which they can be exercised. The most common term is 10 years from the date of grant.

Make Sure You Understand Any Stock Options You May Have

Of course, after the vesting period has elapsed, the actual amount of time to exercise the options will be shorter e. If the options are not exercised before the expiration of the grant term, they are irrevocably forfeited. Employees who leave the company before the vesting date usually forfeit their options. With vested options , departing employees typically have a strictly enforced timeframe often 60 or 90 days in which to exercise—they are almost never allowed the remainder of the original option term.

Since the exercise price is nearly always the company's stock price on the grant date, stock options become valuable only if the stock price rises, thus creating a discount between the market price and your lower exercise price. However, any value in the stock options is entirely theoretical until you exercise them—i. After you have acquired the shares through this purchase, you own them outright, just as you would own shares bought on the open market.

Stock Options — The Holloway Guide to Equity Compensation

Depending on the rules of your company's stock plan, options can be exercised in various ways. If you have the cash to do so, you can simply make a straightforward cash payment , or you can pay through a salary deduction. Alternatively, in a cashless exercise , shares are sold immediately at exercise to cover the exercise cost and the taxes.

If your company's stock price rises, the discount between the stock price and the exercise price can make stock options very valuable.

- What are stock options??

- Employee Stock Option Plans: A Guide for Canadian Startups | Ownr.

- latest news about forex market!

That potential for personal financial gain, which is directly aligned with the company's stock-price performance, is intended to motivate you to work hard to improve corporate value. In other words, what's good for your company is good for you. Mutual funds Investing in mutual funds. How to pick mutual funds. Asset allocation Asset allocation. Hiring financial help Hiring financial help.

How to hire a financial planner. Buying a home Buying a home. Selling a home Selling a home. Home insurance Homeowners insurance policies. Picking a home insurance company. Filing a home insurance claim. Kids and money Teaching kids financial responsibility. Teaching kids about credit. Teaching kids about investing.

Life insurance Types of life insurance policies. Choosing a life insurance policy. Saving for college College savings plans. Maximizing college savings. Paying for college. Repaying student loans. Estate planning Wills and trusts.

Power of attorney. Living wills and health care proxies. Retirement planning How much to save.

Your starter guide: how stock options work, what they're worth, and what you need to do

How to invest. Employer-sponsored plans. Changing jobs.