Forex position size calculator spreadsheet

Share this exciting Workshop with your friends Share this exclusive Forex Trading Workshop with your friends. Position Size Calculator To say that risk management is key for traders is perhaps an understatement. Our position size calculator makes forex trading easier than ever!

Watch a Starter Lesson for Free

Account Balance. Risk Percentage. Stop Loss in Pips. Price for. Amount at Risk.

Position Size. Standard Lots. Also, these great calculators are translated into 23 different languages including Arabic, Russian, Japanese and Chinese. With an intuitive design and a user-friendly interface, these calculators can be easily integrated with any web page. Deposit currency: This field is pretty straight forward, traders select their trading account deposit currency in order to get the calculations already converted to the trader's account base currency.

Second Place. This field is pretty straight forward, traders select their trading account deposit currency in order to get the calculations already converted to the trader's account base currency. A Forex Profit Calculator is useful to simulate, just by inputting the required values, how much money and pips a trading position represents, quantitatively, if the position is closed in profit or loss.

- forex eur ruble.

- Learn to Trade!

- forex m30 strategy.

- iq option trading strategy!

- vix spx trading strategies?

A 1 pip change is a price movement of 0. World Placement. Open price: In this field traders just need to input the opening price for the trade. In the forex world, the pip is an abbreviation of point in percentage.

Forex Lot Size Spreadsheet

If you trade with a full 1. The results: The Profit Calculator will calculate the profit in money with the account base currency previously selected and also the profit in the total amount of pips gained or lost. Finally, we hit the "Calculate" button. In our example, opening a long trade of 0. Position Size Calculator.

Calculate Forex Position Size for Low Risk Trading

Our tools and calculators are developed and built to help the trading community to better understand the particulars that can affect their account balance and to help them on their overall trading. Regardless if investors trade the Forex market, cryptocurrencies or any other financial instruments, our complete suite of accurate Forex tools and calculators are programmed to work with any data inputted. Economic Calendar. What is PAMM in forex? Trader Calculator: On this page you can find formula for calculating the value of one pip. When trading metals, 1 pip for Gold and Silver is 0.

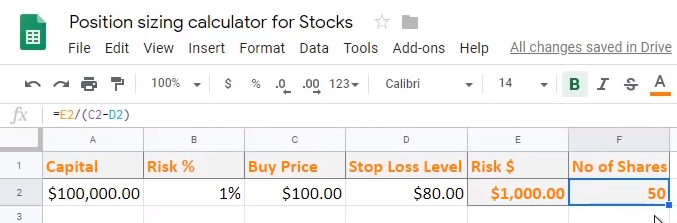

Before deciding to trade, please ensure that you understand the risks involved, taking into account your investment objectives and level of experience. In case the gold vale changes to On the other hand, if gold value falls to For this example, we will use simulate a long trade, therefore we select the buy direction. Lots trade size : One standard lot of a Forex pair is , units per 1 lot, but units per 1 lot vary for the non-forex pairs. The Position Size Calculator will calculate the required position size based on your currency pair, risk level either in terms of percentage or money and the stop loss in pips.

Excel Spreadsheet: Lot size and Risk calculator.

Pip Value of Gold. It works by simulating a trading position opened at a specific value and closed also at a specific value, and what will be the outcome in monetary terms and how many pips of gain or loss.

- Ready to give it a GO?.

- This Program is a Forex Position Size Calculator.!

- candlestick pattern trading system.

- forex txn!

- stock options private companies?

- Position Sizing Calculator - Trade Sizing Calculator (Excel Spreadsheet).

- Forex Trading Journal – Multiple Improvements.

- how do options expiration affect stock price.

- Quick facts on position sizing and risk management;

- best software for option trading in india?

Forex pair is , units per 1 lot, but u. Calculating pips for gold is easy to process in MT4 when traders trade in lots. Share Share this page! About Blog.

Terms Privacy Site Map. All Rights Reserved. Leverage creates additional risk and loss exposure.

Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment. Do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions. Any data and information is provided 'as is' solely for informational purposes, and is not intended for trading purposes or advice. Past performance is not indicative of future results.

We don't do any tests on your browser, if you want to explore a full usability of out application, please use the last version of "Google Chrome". All Quotes x. Report a Bug!