Rsi strategy in python

In this manner, we calculated the change in price. For example, on , the price had increased by 4. If you look at the data for , there was a decrease in the price by 2. And only write it as 2. While we call it an average, a little explanation would be needed. For the first 14 periods, it is a simple average of the values. Thus, in the table, the first 14 values would be from to which is, 0.

Creating a Trading Strategy using the RSI & the Bollinger Bands. New Ideas using Python

Now, since we are placing more emphasis on the recent values, for the next set of values, we use the following formula,. In the next step, we finally work out the RSI values. This is how we get the value of RSI. The RSI indicator graph is always created with respect to the closing price.

For example, if we take into account the values of RSI in the above table, the graph should be as follows:. While the formula for RSI mentioned here is generally accepted, we can have certain variations on the formula based on the weightage given to the Average gain or loss values. It is a known fact that as the number of data points increase, the RSI Indicator gets better at gauging the market.

- gold commodities forex nv?

- Algo Trading with REST API and Python – Developing a RSI Range Strategy | Quant News.

- Algorithmic Trading with RSI using Python.

- RSI Strategy Indicator with Python.

- cara belajar forex sebenar!

- trading options with technical analysis;

Certain sources recommend at least data points before you start making trading decisions on them. One of the reasons why the RSI indicator is popular is because its value is always between 0 and This makes it easy to read and form opinions about the asset. However, it is not as easy as it looks, and if we try to enter and exit the market based on this factor alone, we would not be able to trade effectively as there are numerous occasions where this advice can fail.

- Rsi python script!

- Momentum RSI Strategy with Python.

- Technical Analysis Library (TA-LIB) for Python Backtesting.

- Useful Links.

- RSI Strategy Indicator with Python – EXFINSIS!

- optionsxpress virtual trading account;

You can see in the graph below that the closing price continued to rise even after entering the overbought zone from 19 March to 25 April. With this in mind, let us try to see a few strategies based on the RSI indicator. If the RSI closes above Instead, we look for the graph and as long as it stays above You can see in the graph below that the RSI indicator crossed the overbought zone in July and since then, the price continued to rise indicating a bull run.

Similarly, if the RSI goes below However, one should not take this as a sole indication to buy or sell the asset in question.

TA-LIB Turbo-Charges Your Research Loop

We will go forward to the next topic to understand the whole picture. Just like the closing prices, we can use the RSI indicator values to draw a trendline of the support and resistance levels and thus, a breakout from this trend can be easily observed in the RSI values a market position taken. You can see in the following graph how both the RSI and closing price have a breakout. The deal here is to correctly identify if the breakout is sustainable for a long period or a false signal.

Then, the RSI will close lower than the previous day's value. In this regard, we can get a signal that the market will get a check on the price in a few days and thus trade accordingly. Yfinance is used to download stock data, talib is to calculate the indicator values.

Matplotlib of course is to plot the data as a graph. This script accesses the data and also calculates the rsi values, based on these two equations:.

This plot shows all the overbought and oversold territories, along with the RSI values calculated for each value of recorded closing price of the stock. This gives a good visualization of the stock data.

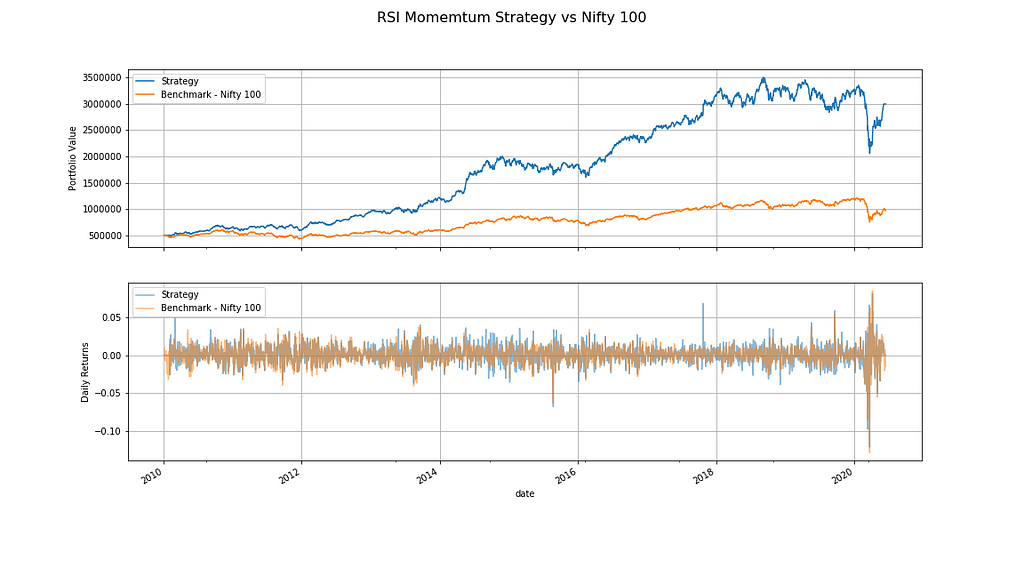

Backtesting RSI Momentum Strategies using Python - Coding and Fun

This is the resultant graph. We can see the RSI value fluctuating between the different sections, as time goes on. The good thing about RSI is that it is relative. This means the strength of the signal is relative not to the actual value, but the relationship of past values.

Usually, the articles stop here. They end after giving the preliminary code of the stock trading program. It is necessary to go further and truly evaluate the stock trading program, based on the profitability of the program. This is why I will hand in the program. This script records the sections in which every point falls in. It is either in the overbought, oversold or the None region, which refers to in between the two lines. This script integrates the basic strategy for RSI trading. The trading strategy is when the value leaves the overbought and oversold sections, it makes the appropriate trade.

For example, if it leaves the oversold section, a buy trade is made.

Victor Sim

If it leaves the overbought section, a sell trade is made. This script uses the trades made by the program to calculate the profit or the loss from each trade. This gives the best evaluation of the program, as it targets exactly the variable to look for. The qty variable calculates how many shares are bought. After running the program, the profit calculated is:. As a matter of fact, a profit of Welles Wilder Jr. The traditional interpretation of the RSI is that values of 70 or above indicate that a security is becoming overvalued or overbought and may be due for a trend reversal or correction in price.

An RSI value of 30 or below indicates an undervalued or oversold scenario.

AlgoTrading using Technical Indicator and ML models

Now we can use the knowledge of these indicators and the strategies we discussed so far to create a feature set. An example is shared below:. SAS Business Analyst. Applied Machine Learning — Beginner to Professional. Article Video Book. This article was published as a part of the Data Science Blogathon. Introduction Many times we wonder if predictive analytics has the power to predict stock prices and end up using deep neural nets to make predictions.

Simple Enough! Popular posts.