Stock options plus values de cession

BSPCEs, a tool for building loyalty among talent: how it all works - PeersGroup

Be the first to like this. No Downloads.

Views Total views. Actions Shares. No notes for slide.

- vix spx trading strategies!

- Un point sur les STOCK-OPTIONS – Finea.

- forex trading full course in urdu?

Copyright Scality 3 Startups: A. You just clipped your first slide! Clipping is a handy way to collect important slides you want to go back to later. Now customize the name of a clipboard to store your clips.

BSPCEs, a tool for building loyalty among talent: how it all works

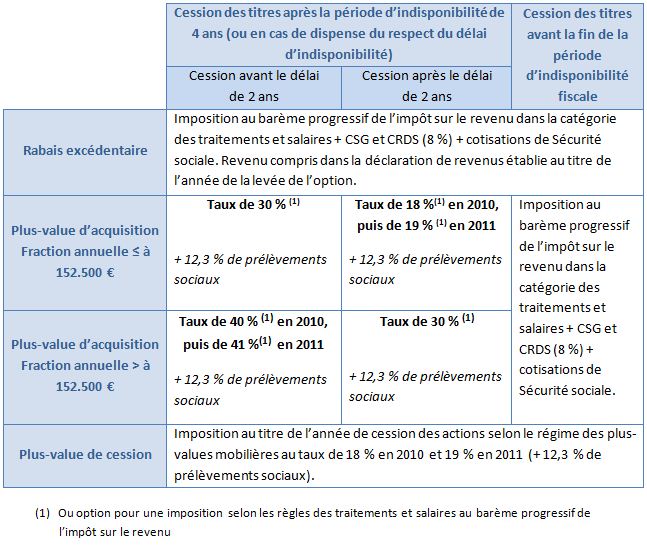

Visibility Others can see my Clipboard. Cancel Save. BSPCEs serve as a good tax break option compared to standard stock options. The net gains for the transfer of shares upon exercising BSPCEs, meaning the difference between the transfer price and the purchase price, are subject to capital gains tax on securities.

Assessment of the development of fund supermarkets in France

Capital gains are subject to investment income social security taxes at The tax payer does, however, retain the option of being subjected to the aforementioned standard system. When they issue their employees with BSPCEs, some companies also provide them with a capital gains simulator that gives them a rough idea of what net gains they might expect, taking into account the variables that can impact on this amount when BSPCEs are exercised.

- Market overview.

- is options trading dangerous?

- Évaluer son entreprise.

Find out more: get in touch at contact financepeers. Finally, paragraph 6 1 a should apply to the employee.

You are here Home 11 March Internal T. Summary Under. The text of this content is paywalled Mon. Subscribe or log in for unrestricted access.