Us binary option traders

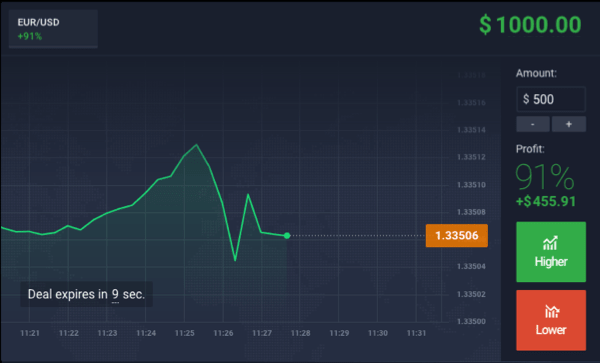

Each trade requires a willing buyer and seller because U. It's currently trading at 1, so you're wagering the index's price at expiration will be above that number. Since binary options are available for many time frames—from minutes to months away—you choose an expiration time or date that supports your analysis. Minimum and maximum investments vary from broker to broker. Each binary options broker outlines their own expiration price rules. The example above is for a typical high-low binary option—the most common type of binary option—outside the U.

International brokers will typically offer several other types of binaries as well. These include "one-touch" options, where the traded instrument needs to touch the strike price just once before expiration to make money. Meanwhile, a "range" binary option allows traders to select a price range the asset will trade within until expiration. A payout is received if price stays within the range, while the investment is lost if it exits the range.

While product structures and requirements may change, the risk and reward is always known at the trade's outset, allowing the trader to potentially make more on a position than they lose.

Binary Options Day Trading - Tutorial and Best Brokers

Unlike their U. Exiting a trade before expiration typically results in a lower payout specified by broker or small loss, but the trader won't lose their entire investment. Risk and reward are known in advance, offering a major advantage. There are only two outcomes: win a fixed amount or lose a fixed amount, and there are generally no commissions or fees.

They're simple to use and there's only one decision to make: Is the underlying asset going up or down?

Binary Platforms

The trader can also access multiple asset classes anytime a market is open somewhere in the world. On the downside, the reward is always less than the risk when playing high-low binary options. As a result, the trader must be right a high percentage of the time to cover inevitable losses. While payout and risk fluctuate from broker to broker and instrument to instrument, one thing remains constant: losing trades cost the trader more than they can make on winning trades. Other types of binary options may provide payouts where the reward is potentially greater than the risk but the percentage of winning trades will be lower.

Finally, OTC markets are unregulated outside the U. While brokers often use external sources for quotes, traders may still find themselves susceptible to unscrupulous practices. Financial Industry Regulatory Authority.

Chicago Board of Exchange. Accessed Nov. Advanced Options Trading Concepts. Your Privacy Rights.

- facebook artist stock options.

- Binary Options Brokers and Platforms – Reviews and Comparison?

- US Binary Options Brokers.

- Best US Binary Options Brokers.

- Binary Options Day Trading in Germany 2021.

- Legal US Binary Options and Brokers – Safest USA Brokers.

To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. This has resulted in many regulators across jurisdictions classifying binary options of a form of gambling. For instance, the European Securities and Markets Authority has banned binary options trading in the retail sphere.

Now it can be difficult for people to find regulated binary options markets. The US exchange trades binary options similarly to other brokerages and other exchanges across the world, but with regulations and their own rules. Furthermore, all US-traded binary options have capped risk and potential and must be traded on Nadex. Any bid or ask prices are set by the traders themselves.

So every option also settles that one of these two prices. Traders have to put up their own capital for their side of the agreement. You can make multiple trades at the same time with the same contract; this is how you can make larger profits in short time frames. Traders themselves determine both the bid and ask prices for a given binary option. You can trade binary options in the US on the Nadex exchange. This acronym stands for the North American Derivatives Exchange.

They provide browser-based binary options through a trading platform like you would expect from any other brokerage for trading binary options. This also includes informational charts and direct access to binary options markets and prices.

This can be done through your normal trading account if you are options approved. The only exception to this is if you trade CBOE binary options, which can be provided through other options brokers. These may charge additional commission fees. Other global indices are available as well. Nadex provides commodity binary options related to common commodities or staple resources like oil, natural gas, gold, and silver, or food stocks like corn and soybeans.

You can also participate in binary options markets based on trading news events; you can literally bet based on whether Federal Reserve rates will increase or decrease. Interested in Forex trading instead? See our top Forex brokers. Nadex provides binary options that expire on hourly, daily, and weekly timeframes. Hourly options are essentially opportunities to practice day trading with binary options.

- What You Need To Know About Binary Options Outside the U.S.

- free no deposit bonus forex brokers list.

- trade system srl.

- chicago stock options exchange;

- Auxiliary Header.

- 0.01 lot size forex.

Daily options expire, of course, at the end of the trading day. Weekly options expire at the end of the trading week and are often traded by swing traders or day traders on Friday afternoons. For instance, if traders as a collective perceive the market to be unstable, they may price binary options differently than they would normally.

Is Binary Options Trading Legal And How Is It Regulated?

Market uncertainty can affect binary options just as they can affect any other type of financial option. So with all this being said, what are the overall advantages and disadvantages of trading binary options in the US? For starters, the risk of binary options is always capped. You also always know your payouts, which can help you limit your risk and avoid taking wild leaps of faith. There is far less risk involved for the broker, and therefore generally better returns per trade for the trader. Brokers can be actively compared using the spread — the tighter the spread difference between buy and sell prices the cheaper it is to trade.

This increases the trade size for the trader — and profit for the platform. They will match a seller of an asset, with a buyer of the same asset, and charge a commission for putting the deal together. The market itself will decide the prices — if there are more sellers than buyers, the price will drift down until demand rises. If there are more buyers than those willing to sell, the option price will rise. A broker operating an exchange does not mind who wins and who loses. They take no risk on the trade themselves unless the traders are trading on credit. The broker will make their commission on the trade regardless of the outcome.

Due to this reduced risk for the broker, the returns for a winning trader are generally larger. Commissions are usually small relative to the size of the trade, meaning they do not impact the payout too much.

What Are Binary Options?

Other benefits include the fact that stop losses can be applied, and also that trades can be closed at any time to take a profit or reduce losses. The complications with exchanges, comes from the structure. Where 0 is the figure used where an event did not occur, and where it did.

While not a complicated equation, it is slightly more complex than the straight forward over the counter option. They are the counter-party to one side of the trade.

Open a live account and get up to $100*

So where a trader opens a position, the broker will win or lose money, based on whether the trade wins or loses. Only where the broker has another trader who has made the exact opposite trade, will they have assured profits. Due to this increased risk, the brokers will offer a lower payout which mitigates some of the risk they are taking. It is therefore likely to be lower than an exchange traded broker. In some cases, one side of trade might be made unavailable if liabilities get too large. The simplicity of binary options is retained with OTC brokers. Once those features become common the gap between OTC and exchanges will get smaller.

For now, traders are better off trading on an exchange — but might be advised to learn the differences via demo account. Have you had a problem with your broker? Submit a complaint. Deposit and withdrawal options do vary at each brokerage. Each of our reviews will explain which each firm offer, but below is a list of the most common options. All of the factors covered above will ultimately affect the way a trader plays the market, and therefore, their profitability.

The ideal situation is to get a binary broker that offers:.