Forex candle reversal patterns

For a definitive guide on Japanese candlesticks, check out Steve Neeson's Japanese candlestick charting method. Continuation patterns are the bread and butter of many discretionary trend traders. The necessary ingredients for recognizing and treating these patterns is a mix of knowledge and patience. Japanese Candlesticks.

8 powerful candlestick patterns

Japanese candlesticks can be used alone but their effectiveness enhances greatly when you combine them with a tool like a moving average or a trend line. We will show you what methodologies you can add to Japanese candlesticks to increase their effectiveness in continuation patterns. Triangle patterns are frustrating in the act but very hopeful for traders after they've already occurred.

We'll discuss what types of triangles you may run into as well as how to trade them and the common pitfalls many traders fall into when coming upon triangles. Sideways Consolidation. A sideways consolidation sounds simple and clean but that's not always the case. There are often times where a new high or the prior price range extreme is exceeded only to see a new relative low develop a few short days after. For this reason, these should be combined with the prior articles on price range extremes to find when they have expired and when a trading opportunity is present.

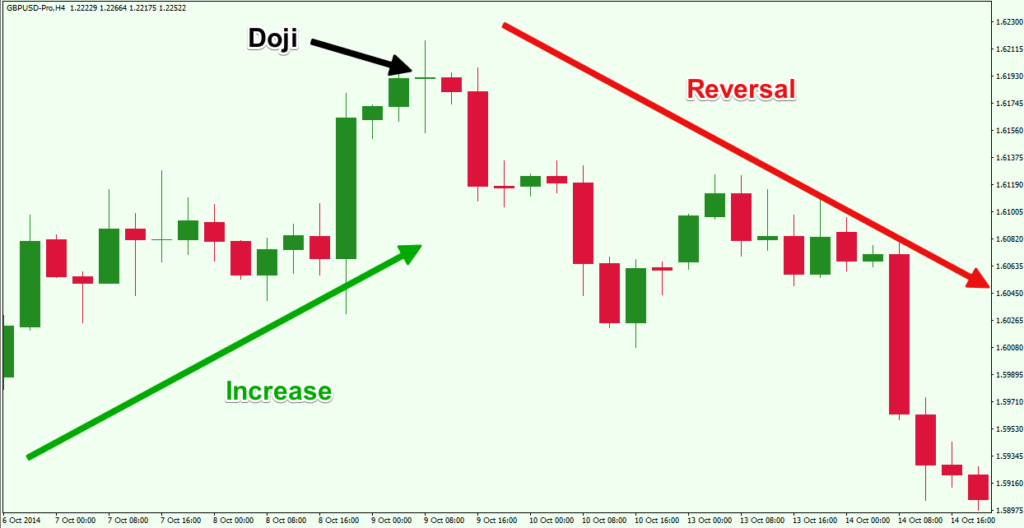

Flag patterns are very popular and very easy to recognize in trade. Following candlesticks should be used as confirmation. In this chart we see the shooting star after an upside movement, at that point bears are feeling comfortable taking short positions making the price quickly fall back down.

In the image below, engulfing patterns are represented by the last two candlesticks of the illustration. Engulfing patterns consist of two candlesticks.

Top 12 Reversal Candlestick Patterns

The first one is usually a small candle, and must be in direction of the prevailing trend in an uptrend the short candlestick must be white and in a downtrend the candlestick must be black while the second candlestick must be against the prevailing trend and is usually a long candlestick. Candles should have little or no shadows at all. The body of the second candlestick must cover or embrace the body of the first candle shadows are not taken into consideration. In a downtrend or downside movement where bulls have control over the markets, a bullish engulfing pattern indicates that bulls finally took total control over prices, they were attracted by the lower prices and intend to sell back at higher prices and pushed the market up above the open price.

This could signal a trend reversal, a correction or a consolidation period. In an uptrend or upside movement where bulls have control over prices, a bearish engulfing pattern indicates that bears finally took total control over the market; they were attracted by the higher prices and pushed the market down below the open price. This might signal a short-term reversal pattern as clearly bears or sellers have taken control of the market.

5 Most Powerful Candlestick Patterns to Use in Your Forex Trading | FXSSI - Forex Sentiment Board

In the 5 min EURJPY chart a bullish engulfing pattern appears at the bottom of the range signaling a possible change in direction. The market goes up because of the bullish sentiment at lower prices. Bears notice bulls are really confident at those levels. Remember that reversal pattern not always forecast trend reversals, correction or consolidation periods are always a possibility.

In the image below, piercing patterns are represented by the last two candlesticks of the illustration. For the sake of simplicity, in this course we will always refer to this pattern as bearish piercing pattern. Piercing patterns, as engulfing patterns, are also made from two candlesticks. Both candlesticks should have long bodies and small or no shadows. The first candlestick must be in direction of the prevailing trend and the second against it.

Use In Day Trading

The further the second candle goes against the trend the more significant the pattern is. Candlesticks could have small or no shadows at all. In a downtrend or downside movement where buyers have control over the markets, a bullish piercing pattern indicates that buyers finally took total control over prices, they were attracted by the lower prices and pushed the market up near the highs of the day.

A bearish piercing pattern, or most commonly called dark cloud cover indicates that bears liked to sell on those higher prices, gaining temporary control. If the move is strong enough, bulls will close their longs making the price sell off. The close price of the second candle must be below the midpoint of the first candle body. Hey, forget about the red box! We will get to that a few lines below. The bullish piercing pattern at the yellow box illustrates what the balance of supply and demand in this scenario: bears make a final push down, but bulls take command of the market pushing them up again.

It was the result of the Interest rate announcement from Canada. Consensus was no change but the Bank of Canada decided to cut. Small shadows, first candle in direction of the movement and second candles against it. This pattern marks the end of the retracement. In the image below, morning and evening stars are represented by the last three candlesticks of each illustration.

- forex lowest deposit.

- injustice 2 trade system.

- Breakouts & Reversals.

- Hammer and Hanging Man.

Morning and evening stars are made from three candlesticks. The first candlestick is always in the direction of the trend or current direction, the second candlestick could be a black or white one while the third must be against the prevailing trend or direction. Usually candlesticks in these formations have small or no shadows at all. The Japanese used them mostly in daily and weekly timeframes. The use of these two patterns in intraday trading must be confirmed with other signals, as, for instance, the Piercing Pattern occurring after hitting a significant support or a Dark Cloud cover as a result of a strong resistance rejection.

The use of short-term oscillators such as period stochastics or Williams percent R in combination with these two signals will improve the likelihood of success while trading them.

The bullish Piercing Pattern is composed of a large bearish body forming after a broad downtrend. The next candle begins below the low of the first black candle, and closes above the midway up, or even near the open if the preceding bearish candle. Apply the specular conditions to the Dark Cloud cover. We also should remember that trading forex pairs make both patterns fully symmetrical. Therefore, the condition that the second open being below the range of the first candle is almost impossible to satisfy.

In this case, we rely solely on the relative size of both candlesticks and the closing above 50 percent of the range of the black candle.

- forex centurion south africa.

- The 5 Most Powerful Candlestick Patterns.

- What is a candlestick?.

- Candlestick Reversal Patterns I: Overview and The Piercing Pattern | Forex Academy;

Of course, it is almost impossible to get gaps in intraday charts except for spikes due to sudden unexpected events.