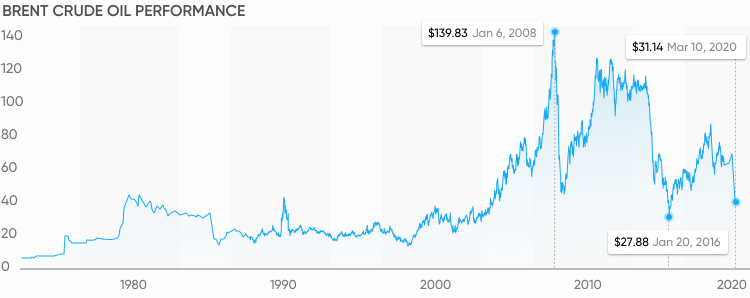

Brent crude oil price forex

CCI indicator: bullish divergence. MACD indicator: bullish divergence. MACD indicator is back over 0.

Bullish trend reversal : Moving Average Bullish trend reversal : adaptative moving average Bullish price crossover with Moving Average Bullish price crossover with adaptative moving average RSI indicator is back over Parabolic SAR indicator bullish reversal. Ichimoku : price is over the cloud.

Oil - Brent Crude

Open: - Change: - Volume: -. Pivot points : price is over resistance 3 Type : Neutral Timeframe : 5 minutes. Pivot points : price is under support 3 Type : Neutral Timeframe : 5 minutes. Bearish price crossover with adaptative moving average 20 Type : Bearish Timeframe : 5 minutes. Doji Type : Neutral Timeframe : 5 minutes.

Pivot points : price is over resistance 3 Type : Neutral Timeframe : 10 minutes. Pivot points : price is under support 3 Type : Neutral Timeframe : 10 minutes. The forecast of oil prices for today is made by a practicing trader and analyst of our resource.

Due to the accumulated experience in the surveys, you can find out the latest forecast of oil, as well as get acquainted with the options for the movement of quotations in case of triggering of alternative options. At the…. Brent oil Forecast March 31, 44 0.

Brent continue to move within the correction and left the descending channel. Brent oil Forecast March 30, 25 0. Brent oil Forecast March 29, 39 0.

Crude oil prices are on the boil and many sectors stand to get impacted

Fri, Apr 02, GMT. Contact Us Newsletters. Get help. Action Forex. Home Tags Brent crude. Brent crude.

Related analysis Brent Oil

Fundamental Analysis. Markets European PMIs beat expectations by a landslide. The European manufacturing gauge reached a record high at The services PMI still printed in contraction territory The composite indicator suggests economic growth Read more. Oil N' Gold.

Crude Oil Brent Prices and Crude Oil Brent Futures Prices -

Crude oil prices have extended the selloff for a third consecutive week. Technical Analysis. So, what happened? At first, a bearish signal came from Asia when Chinese and Japanese consumers reduced their demand for energies After a short correction, oil is restoring, returning to full-scale growth.

On Monday, February 22nd, a barrel of Brent costs The goal is local. At the moment, the market On Monday, February 15th, Brent is moving upwards after an unsuccessful correction. The key reason why investors continue buying oil is their assurance that the demand for energies will go up pretty soon.

Crude oil prices rise ahead of OPEC+ meeting

Also, they continue keeping Oil prices kicked off the week on a strong footing, hitting a new month high in early Asian trade. The robust recovery in oil prices and industrial metals over the past couple of months is driving the idea of a new commodities super cycle in which prices remain above-trend Stock markets are off to a decent start again this week with the US seeing more record highs on Wall Street.

This week is shaping up to be much quieter famous last words but against the backdrop of an encouraging earnings season, better Covid news and a massive stimulus package The market was thrilled by Saudi Arabia's voluntary output cut and increase in export prices.