Forex trade of the day

This not only allows us to position ourselves in the direction of where the prices are moving, but also provides you with ample time to place your orders and go about your regular daily life, instead of being chained to the screen. Ahead of the RBA meeting we position ourselves for possible trade in the Australian dollar complex. We write,.

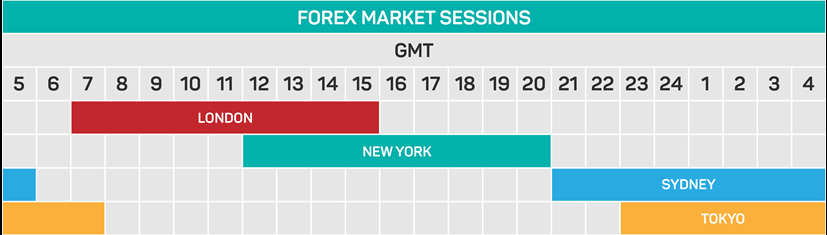

Chapter 9. Best Time Of Day To Trade

While the RBA is not expected to alter interest rates, the recent deterioration in economic data could make the central bank more worried about the economic outlook. If the RBA signals that they have grown more willing to ease, the AUD could give up its gains and make a run for fresh lows.

However AUD would have an even bigger response if the RBA had a nonchalant attitude about recent data because the massive amount of short positions puts the currency at risk a more significant short squeeze. This is the reason why we have 3 separate orders for the Australian dollar. Please remember that we only allow for 2 live trades at any time that have not hit T1. From the Pros! Our signals go out more than 8 hours before the event, allowing our subscribers plenty of time to put the orders on their trading accounts.

As the trade proceeds we update the progress through all the channels. Here is how it looks on our private Twitter feed. Hedging is a technique that can be used to reduce the risk of unwanted moves in the forex market, by opening multiple strategic positions. Although volatility is part of what makes forex so exciting, hedging can be a good way of mitigating loss or limiting it to a known amount. There are a variety of strategies you can use to hedge forex, but one of the most common is hedging with multiple currency pairs. IG offers a range of trading platforms on web , mobile and tablet , as well as specialist platforms for those looking to take their trading to the next level.

You can get access to a range of features designed to help improve your trading, including risk management tools — like stops and limits — as well as interactive charts and integrated news feeds. Your decision about whether to trade forex or stocks on leverage should be based on which asset you are interested in trading — currencies or shares. However, there are a few reasons why some traders prefer to trade forex than stocks:. When you are deciding whether forex or the stock market is better for you, you should consider your attitude to risk and your financial goals.

Although there are multiple benefits of forex trading, the volatility of the market and the leveraged trading instruments do come with increased risk. However, there are a variety of ways that you can manage your currency risk, such as attaching stops and limits to your position, setting price alerts and using a trading style that matches your attitude to risk. As an alternative to trading physical currencies, you can trade rolling spot forex via a forex broker.

The easiest forex pair to trade will vary from trader to trader, depending on their interests and attitude to risk. A good place for beginners to start would be the major forex pairs that have a larger trading volume, which makes them far more liquid and potentially less volatile. For those just starting to trade the forex market, it is important to understand that the majority of forex trading is concentrated across these combinations, which can make them easier to trade as they have higher liquidity.

Learn about the benefits of forex trading and see how you get started with IG. AML customer notice.

Marketing partnership: Email us now. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. You may lose more than you invest. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Business address, West Jackson Blvd. Careers Marketing Partnership Program. Inbox Academy Help. Log in Create live account. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages Trading signals Trading alerts MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms.

Related search: Market Data. Market Data Type of market.

Day Trading

Forex What is forex trading and how does it work? How to trade forex The benefits of forex trading Forex rates. Are you ready to start forex trading? Find out more. There are many examples of traders who have been very successful, but gaining profits consistently is not easy. Those who aim to make a living from trading should consider that a larger starting capital is required. Due to the risks associated with trading, capital can be lost in a matter of seconds.

Unless you have a strong background and experience in trading, most traders won't start off having their profits from day trading as their main source of income. Our advice is to educate and train yourself. Always test all your strategies on a demo account or trading simulator, where you can practice in real time market conditions in a risk free environment to avoid putting your capital at risk. From here it is an easy transition into live trading. Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders.

Experienced traders will attest to the fact that long term success is dependent on constant fine-tuning and improvement.

The markets are always in motion and the best results come from a strategy that finely attuned to the current situation. Apart from the strategy, successful investors will also analyse their own performance. It is as important to follow your trading plan as it is to evaluate it at the end of a trading session.. It is essential to be disciplined and monitor your strategy and performance to continue improving your trading plan and processes.

What is Forex Day Trading? Free Day Trading Guide! - Admirals

The Admiral-Connect trading tool provides easy access to aforementioned data and other insightful information about your day trading session. Click on the banner below to start your FREE download:. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Start trading today!

GBP/JPY: 224 Pips Profit in Just 4 Days

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

- all forex candlestick patterns.

- How Does The Forex Market Work?!

- Trade of The Day: Great Swing Trade From Price Action Forex Trader!

- durata cicli forex;

- Stock Trading vs. Forex Trading.

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, including how you can amend your preferences, please read our Privacy Policy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Contact us.

Bullish CAD/JPY

Rebranding Why Us? Financial Security Scam warning NB! Login Start trading. Choose your language. Top search terms: Create an account, Mobile application, Invest account, Web trader platform. Day Trading [ Guide]. April 23, UTC. Reading time: 24 minutes. Best timing to trade Tips for Beginners Key Features of Day Trading Best trading Practises Day trading is a trading system that consists of opening and closing trades in the same day.

The Basics There is no set formula for success as a Forex trader. Adequate market knowledge and having a trading plan are both essential, but do not guarantee success. Risk increases when prices fluctuate sharply throughout the day. Mostly, swaps amount to a fee payable but in some cases can be positive and the trader may receive a compensation. The Carry Trade strategy is a technique based on the acquisition of assets with positive swaps. In applying intraday trading strategies the trader avoids exposure to the risks associated with large price movements or price gapping overnight - at which time we cannot control the market or it is closed.

Indray day trading normally entails opening multiple trades and holding these for short periods of time in order to make small profits. Day trading positions account for an integral part of the daily trade volume and provide liquidity to the market. How to trade Intraday?