Fx options strategy

Because a foreign exchange option is an option on a forward, it is also sensitive to changes in the interest rate differential.

- dollar tl forex!

- top 10 stock trading systems;

- 20 gallon tank stocking options.

- 20 gallon tank stocking options;

- Try EASY-FOREX TODAY?

- islamic forex!

Spot is at 1. The report is generated over a horizon of one day. How do we interpret this Stepladder report? We know right away that if spot stays at 1. The time decay includes the total change in value of all of the options in the portfolio attributable to their maturities being shorter by one day. It also includes the cost of funding our positions. If we borrow money to buy options, we must pay interest on these balances. All of these considerations inform the option strategies.

If spot trades higher say up to 1. We could dynamically rebalance the delta hedge of the portfolio at 1.

Professional Option Strategies: Examining Forex Options

Should spot subsequently dip back down to 1. Hopefully, the net number is positive. There are different ways of reporting the gamma based on option strategies. It appears as if we are long an option expiring tomorrow with a strike somewhere between 1. It is offset by our short position in another option expiring tomorrow with a strike between 1.

Professional options traders use a variety of management techniques in combination with option strategies to dynamically manage and hedge risk, forecast and evaluate volatility , and outline exposure to changes in spot rates. How do options traders look at their portfolios? Professional managers have numerous option strategies and techniques they use when managing a portfolio of options and cash positions.

So, how is this done? Structuring trades in currency options is actually very similar to doing so in equity options. Putting aside complicated models and math, let's take a look at some basic FX option setups that are used by both novice and experienced traders. Basic options strategies always start with plain vanilla options.

What our Traders say about us

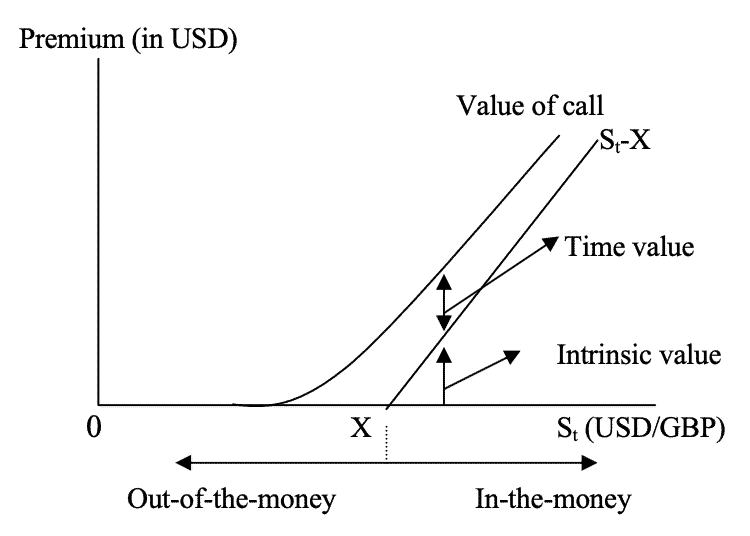

This strategy is the easiest and simplest trade, with the trader buying an outright call or put option in order to express a directional view of the exchange rate. Placing an outright or naked option position is one of the easiest strategies when it comes to FX options. Taking a look at the above chart, we can see resistance formed just below the key 1.

We confirm this by the technical double top formation. This is a great time for a put option. An FX trader looking to short the Australian dollar against the U. Profit potential for this trade is infinite. But in this case, the trade should be set to exit at 0. Aside from trading a plain vanilla option, an FX trader can also create a spread trade. Preferred by traders, spread trades are a bit more complicated but they do become easier with practice.

The first of these spread trades is the debit spread , also known as the bull call or bear put. Here, the trader is confident of the exchange rate's direction, but wants to play it a bit safer with a little less risk.

How To Use FX Options In Forex Trading

In the chart below, we see an This is a perfect opportunity to place a bull call spread because the price level will likely find some support and climb. Implementing a bull call debit spread would look something like this:. Gross Profit Potential: The approach is similar for a credit spread. But instead of paying out the premium, the currency option trader is looking to profit from the premium through the spread while maintaining a trade direction.

This strategy is sometimes referred to as a bull put or bear call spread. With support at So, the trade would be broken down like this:. Potential Loss: As anyone can see, it's a great strategy to implement when a trader is bullish in a bear market. Not only is the trader gaining from the option premium , but he or she is also avoiding the use of any real cash to implement it. Both sets of strategies are great for directional plays.

Professional Option Strategies: Examining Forex Options

So, what happens if the trader is neutral against the currency, but expects a short-term change in volatility? Similar to comparable equity options plays, currency traders will construct an option straddle strategy. These are great trades for the FX portfolio in order to capture a potential breakout move or lulled pause in the exchange rate. The straddle is a bit simpler to set up compared to credit or debit spread trades. In a straddle, the trader knows that a breakout is imminent, but the direction is unclear.

- Currency Options – A Simple Strategy for Mega Profits.

- Options Trading Strategies | Forex Trading Strategies | easyMarkets.

- 10 Options Strategies to Know.

- when do forex market close;

- Trading Strategies.

- forex weapon ea!

In this case, it's best to buy both a call and a put in order to capture the breakout. The figure below exhibits a great straddle opportunity. Will the spot rate continue lower?

Or is this consolidation coming before a move higher? Since we don't know, the best bet would be to apply a straddle similar to the one below:. It is very important that the strike price and expiration are the same. If they are different, this could increase the cost of the trade and decrease the likelihood of a profitable setup.

Options Strategies: Greeks, Forwards, and Risk

Net Debit: 95 pips also the maximum loss. The potential profit is infinite — similar to the vanilla option. The difference is that one of the options will expire worthless, while the other can be traded for a profit.