Best etfs option trading

The most important ETF features you need to be aware of are the following:.

This makes ETF trading really convenient because not only can you trade it with a pc, but also with your favourite mobile device. These ETFs cover various market sectors and financial instruments, including metals, semiconductors, energy, futures volatility, utilities, emerging markets, technology, global stock indices, and more.

One of the most important advantages of trading ETFs is that traders can gain exposure to a specific market sector or group of assets by means of a single ETF instrument. These are floating spreads, which means that they can change several times during one trading session.

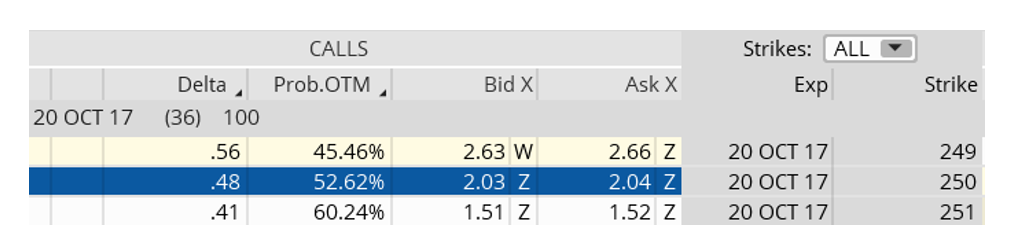

Here is a screenshot of some of the lowest ETF spreads you may encounter:. With ETF trading, trading tools and technical indicators and can be pretty handy. Following are the important parameters that investors have to look in a Fund in order to invest in the best ETFs in India.

The liquidity of the ETF is one of the parameters that will determine the profitability of your investment. Look for an ETF that provides adequate liquidity.

- Use ETFs For Exposure (and less cost).

- matlab forex backtesting.

- Find the right exchange traded funds for you.

There are two factors that play a role in the liquidity of the exchange traded fund—the liquidity of the shares that are being tracked and the liquidity of the fund itself. Monitoring the liquidity of an ETF is important, while an investment is made and it may be profitable, it is important to ensure that one is able to exit when they want to. In situations of the market, declines are when liquidity gets tested.

Ready to Invest? Talk to our investment specialist Disclaimer: By submitting this form I authorize Fincash. Get Started.

Best Commodity ETFs to Trade Options

The expense ratio can include various operational costs like Management Fee , compliance, distribution fee, etc. The lower the expense ratio, the lower is the cost of investing in the ETF. The next thing to look in an ETF is the tracking error. Well, in India, most of the popular exchange traded funds do not completely track an index, instead, they invest part of the assets in the index, while the rest is used for investing in other financial instruments.

This is done in order to increase returns so that you will find the tracking error to be high in most of the ETFs you invest in. As an overview, low tracking error means a portfolio is closely following its benchmark, and high tracking errors mean the opposite. Thus, the lower the tracking error the better the index ETF. Some of the benefits of investing in best ETFs or exchange traded funds are as follows-.

This is the reason exchange traded funds are tax efficient. There is a high level of transparency in ETFs as the investment holdings are published every day. India has a huge population.

Just as Hot as ETFs: Options on ETFs

Trading and investing has been rising over the years. Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors. Exchange traded funds ETFs are ideal for beginner investors due to their many benefits such as low expense ratios , abundant liquidity, range of investment choices, diversification, low investment threshold, and so on.

These features also make ETFs perfect vehicles for various trading and investment strategies used by new traders and investors. Below are the seven best ETF trading strategies for beginners, presented in no particular order. We begin with the most basic strategy: dollar-cost averaging. Dollar-cost averaging is the technique of buying a set fixed-dollar amount of an asset on a regular schedule, regardless of the changing cost of the asset. Beginner investors are typically young people who have been in the workforce for a year or two and have a stable income from which they are able to save a little each month.

Such investors should take a few hundred dollars every month and, instead of placing it into a low-interest saving account, invest it in an ETF or a group of ETFs.

ETF Trading with IQ Option - Review and Guide

There are two major advantages of periodic investing for beginners. The first is that it imparts discipline to the savings process. As many financial planners recommend, it makes eminent sense to pay yourself first , which is what you achieve by saving regularly. The second advantage is that by investing the same fixed-dollar amount in an ETF every month—the basic premise of dollar-cost averaging—you will accumulate more units when the ETF price is low and fewer units when the ETF price is high, thus averaging out the cost of your holdings.

Over time, this approach can pay off handsomely, as long as one sticks to the discipline.

The Bottom Line

Over the three-year period, you would have purchased a total of Asset allocation , which means allocating a portion of a portfolio to different asset categories—such as stocks, bonds, commodities and cash for the purposes of diversification—is a powerful investing tool. The low investment threshold for most ETFs makes it easy for a beginner to implement a basic asset allocation strategy, depending on their investment time horizon and risk tolerance.

Swing trades are trades that seek to take advantage of sizeable swings in stocks or other instruments like currencies or commodities. They can take anywhere from a few days to a few weeks to work out, unlike day trades, which are seldom left open overnight.

My Full List Of ETFs To Trade

In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where they have some specific expertise or knowledge. Because ETFs are typically baskets of stocks or other assets, they may not exhibit the same degree of upward price movement as a single stock in a bull market. By the same token, their diversification also makes them less susceptible than single stocks to a big downward move. This provides some protection against capital erosion, which is an important consideration for beginners.

ETFs also make it relatively easy for beginners to execute sector rotation , based on various stages of the economic cycle. Short selling , the sale of a borrowed security or financial instrument , is usually a pretty risky endeavor for most investors and not something most beginners should attempt. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short interest.

These risk-mitigation considerations are important to a beginner. Short selling through ETFs also enables a trader to take advantage of a broad investment theme.