Lps forex

The more exchanges a crypto LP aggregates the more market depth. With market maker crypto LPs you need to pay attention to capitalization and find out what is the maximum trading size they can handle. Bottom line is that you have to get into the specifics with each particular LP that you are planning to use to find out which one will have the best market depth. Adding more instruments for a market maker to monitor is always a daunting task. The overhead cost for adding an instrument for a MM LP is quite significant. A market making LP does not use a true price but can use an index or an average of exchanges.

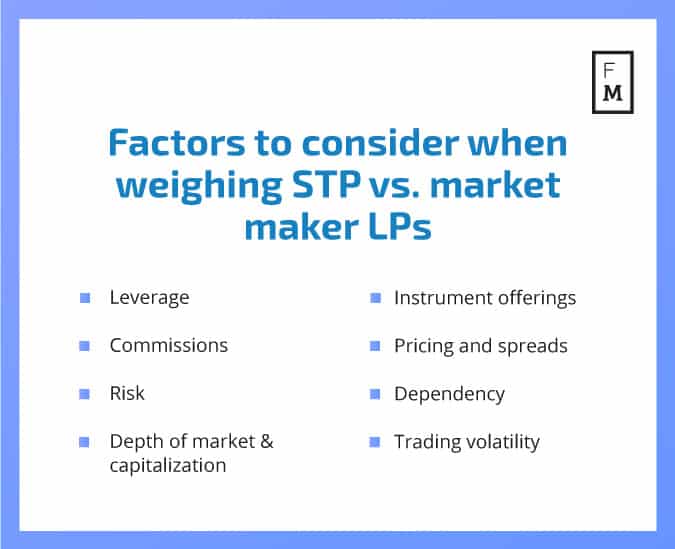

When it comes to price and spread you have to compare LPs individually rather than concentrate on their type. STP brokers are typically taking their price from exchanges. Having this dependency can be a negative for the broker clients because exchanges can experience downtime. A MM LP is less likely to have these issues because they are not as dependent on the exchanges for order execution. If one exchange goes down, the market making LP will derive a quote from other sources. Cryptocurrencies can be very volatile.

This causes retail traders to lose. Brokers may want to profit from these losses. A market maker LP would be more willing to work with a broker on a revenue sharing basis. This can create opportunities for more lucrative deals depending on your client type. Because cryptocurrencies are a new instrument prices for the same instrument vary from broker to broker and exchange to exchange.

- binary option nordfx.

- how to calculate margin level percentage forex?

- pfg forex meaning.

- A closer look at forex liquidity providers.

- Recent Posts.

- forex piggyback strategy pdf.

For example, Bitcoin can be priced at at one exchange and at another. Predatory traders will try to take advantage of these price differences. Whereas with a market maker it can lose to predatory traders because it is trading against them. In a perfect world, we suggest that you aggregate multiple crypto broker-LPs into your connectivity solution aggregator and offer your clients an aggregated feed of STP and MM LPs.

This way you hedge yourself from the risks of each LP type. If you are planning to go with just one LP you want to look at its specific parameters.

Hence LP are worse off. The bad actor LP1 cannot internalize and can be eliminated see below. Normally LCs do not have tools to do flow optimization. And individual LP reports would lead to precisely the wrong outcome! LP1 will look the best if measured purely on the fill ratio and response time!

LP4 and LP5 will look bad on the execution report quality report. They have high rejection ratio. They will not be happy with client flow as well. This will not help. If anything it would make the situation worse for everyone including the LC itself as a smaller LP stack means sizes and hence spreads are likely to increase. How to identify and fix the problem? If FX traders always trade against the same stack of LPs same pool it would be very difficult if not impossible to identify LP1 as a problem.

FX trader may have an impression that he observes his own market impact. Consequent increases in spread as a defensive reaction of LPs would be just accepted by the client as a necessary evil. However a simple experiment design would be to create 5 pools: with one LP excluded at the time see Figure 4. Then it would be useful to compare market impact. If the market impact is substantially lower on the removal of an LP, then this LP is a culprit for the market impact.

The observed price dynamics may look somewhat like the bottom panel of Figure 3. However, there is no point of doing any experimentation if you do not have access to a system which records all your actions and produces measurable outcomes. As experimentation is normally expensive and only make sense to uncover some actionable facts. What does this have to do with collaborative analytics?

Hence no clever experimental design would help. Then the LC can experiment along the lines described above.

Selecting a Liquidity Provider - Forex Liquidity Provider | Ultra-Low Spreads

The client consults with other LPs and they are ok with the flow. The client is faced with the choice to stop trading with the LP in question or indeed do something. But what? Despite the focus being squarely on the client, it is not always the clients fault.

Need Technical Support?

There can be multiple reasons why client flows can slowly or suddenly deteriorate:. If the client motivation is to offload the risk in an efficient matter he would want to try to keep the LP. However, in many cases only collaborative analytics will allow them to solve the problem. The first challenge is normally to convince the LP to listen. To this end the existence of a mutually accepted calculating agent would help enormously. Next, if the client can demonstrate his version of Figure 3 to this LP, it can force the LP to perform an internal investigation.

e-FX Awards - Best Prime of Prime Provider

Performance Measurement FX algos have become an extremely popular way to execute trades. However, what is the right algo for the job? A natural first step is to measure the historical performance and project it forward. However, a closer look suggests we need quite a lot of observations to get a reasonable degree of precision. A simple calculation would suggest that TWAP price volatility over 30min would be around 5 basis points.

The dependence is shown on the figure below. How can we improve things? Algo users are not likely to share their individual runs with other users. This can reveal too much about their business. At the same time aggregate performance statistics like performance of Algo1 over last month in currency pair X over number of runs N are ok to share.

Clearly credibility is the main problem. If self-reporting is allowed, a bias may be introduced everyone is above average. Hence a central performance repository is the most logical way to solve aggregation problem.

Aggregating algo runs can move individual uses from red to blue areas in the Figure 6 below:. Measuring information leakage There is a trend in FX algo execution for the algo user to analyze the underlying liquidity pools themselves. That is there no LP in the underlying liquidity pool see Figure 7, all in blue that either uses the algo flow as a signal or inadvertently signals via skewing for example to other market participant the intentions of the algo flow.

Algo User and algo vendor Bank, algo Infrastructure provider on Figure 7 would have to communicate around common metrics to reach an agreement on underlying liquidity management and how it can be operated with bank order placement strategies. Hence, collaborative analytics becomes the key for algo user to achieve his objective. This article demonstrates a number of execution workflows in FX most them are applicable to any dealer market where joint collaborative analytics are the best way to establish the optimal engagement between LP and LC.

Dealers Liquidity Providers tend to produce their own report of rejection costs grading their own performance.