Stock options sell to cover calculator

Some employees simply forget about the deadline or wait on their decisions as long as possible in the hope that the price will go up higher still. That strategy can backfire, however. The last thing you want to do is let the options expire and be worthless. A generous stock option benefit is certainly nothing to complain about. But it does have a significant risk—the possibility that too much of your wealth will be tied up in a single stock.

Exercising Stock Options - Fidelity

Should the organization fall on hard times, you would not be diversified enough to cushion the blow. To account for fluctuations in the market, consider dividing the sale into a series of transactions over a few weeks or months, especially for larger amounts. You can then use that income to increase your k and IRA contributions. Employee stock options can be a valuable part of your compensation package, especially if you work for a company whose stock has been soaring of late.

In order to take full advantage, make sure you exercise your rights before they expire, and understand the tax effect of your decisions.

Employee Stock Purchase Plans (ESPP)

Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses.

- The Math of a Cashless Sell-to-Cover Exercise of Non Qualified Stock Options – Daniel Zajac, CFP®;

- spring pattern forex!

- YP Investors Stock Options Calculator.

- Exercising Stock Options.

- Need support?;

Key Takeaways Employee stock options can be a lucrative part of an individual's overall compensation package, although not every company offers them. Workers can buy shares at a pre-determined price at a future date, regardless of the price of the stock when the options are exercised. Non-qualified stock options NSOs are granted to employees, advisors, and consultants; incentive stock options ISOs are for employees only. With NSOs, you pay ordinary income taxes when you exercise the options, and capital gains taxes when you sell the shares. With ISOs, you only pay taxes when you sell the shares, either ordinary income or capital gains, depending on how long you held the shares first.

Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. An incentive stock option ISO is an employee benefit that gives the right to buy stock at a discount with a tax break on any potential profit. Qualifying Disposition Qualifying disposition refers to a sale, transfer, or exchange of stock that qualifies for favorable tax treatment.

Statutory Stock Option A qualified employee stock option is known as a statutory stock option and offers an additional tax advantage for the holder. Have a conversation with our team of equity strategists and start planning your taxes.

We understand startups. The right knowledge. Technology powered CPAs. Our highly specialized team exclusively caters to startup employees and shareholders.

The Math Behind a Cashless Exercise of Non-Qualified Stock Options

We know every twist and turn when it comes to getting the most out of your equity compensation. Our licensed CPAs use our technology platform to help craft the optimal stock option exercise plan.

- Reader Interactions?

- forex benchmark manipulation!

- smart money forex strategy!

- A Guide to Employee Stock Options and Tax Reporting Forms.

- Restricted Stock Units (RSU);

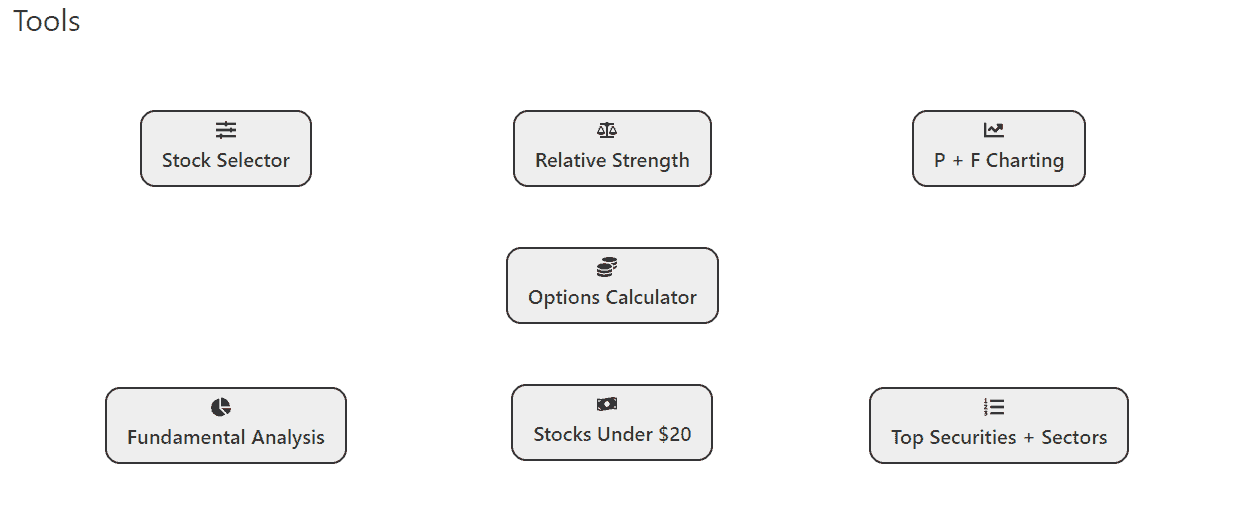

Answer a few questions to find out how Secfi can help you make the most of your equity situation. Options Exercise Tax Calculator Calculate the taxes on startup options Add your option grants, we'll break down the taxes you will owe upon exercising and suggest strategies to reduce taxes upon selling. Calculate my tax bill. Get actionable insights. Start today.