Forex chart patterns strategy

Just because they are formed with more sessions and candlesticks does not mean that you have to use them for longer forms of trading only. There are many patterns you can use for short term trading and patterns that can also be used to make intraday or scalp trades. You can use chart patterns in different ways in your trading, but the most popular is to find and then make high probability trade entries. Chart patterns repeat time and time again. The reason they continue to form and continue to repeat is because each pattern is price showing you what traders are doing through the price action.

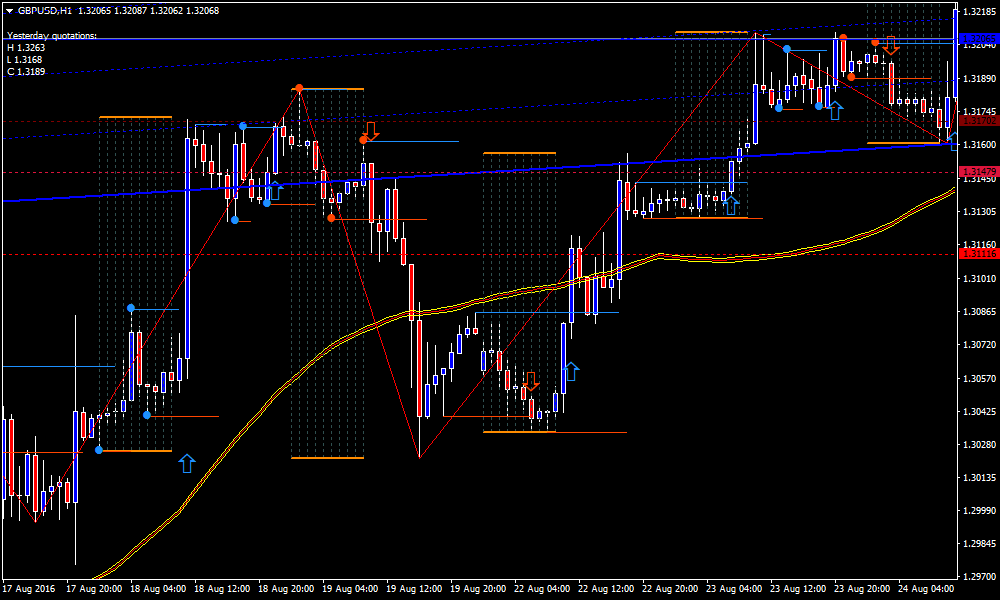

Bullish Pennant Chart Pattern Forex Trading Strategy

Given similar sorts of circumstances traders will tend to behave in the same ways over and over again. Think about how traders get greedy when looking to make money or fearful when they start losing it. This is the same reason why the same patterns continue to form over and over again. Traders do the same things over and over again in the markets which creates the same patterns.

You can use this knowledge to your advantage by finding and then trading these patterns to make profitable trades. There are endless amounts of chart patterns you can learn to use in your own trading.

Often the best way is to find one or two classic chart patterns and then mastering them so you know them back to front. This is far better than finding and trading 20 x different patterns, but being very average at them all. Once you know how to identify it you will start to see it on all your charts and time frames and you will see how profitable it can be.

When done correctly this pattern can be incredibly reliable.

The head and shoulders pattern is formed with three peaks and a neckline. The second peak is the head and the third peak is the right shoulder. You can read more about how to find and trade the head and shoulders pattern here. This pattern is formed with two peaks and a neckline. For example; with a double top we need to see price form two peaks rejecting the same resistance level. For a double bottom we need to see price forming two swing lows rejecting the same support level.

You can read more about how to find and trade the double top and bottom here.

Charting patterns are not just for the higher time frames and you can use them for both day trading and intraday trading. The most commonly used pattern that is used by everyone from the big banks right down to the smallest retail trader is support and resistance. When buying or selling the bounce you are looking for the support or resistance level to hold and for price to make a reversal. When a trendline is drawn along the similar swing highs it creates a horizontal line.

The trendline connecting the rising swing lows is angled upward, creating the ascending triangle as demonstrated in figure two.

Know the 3 Main Groups of Chart Patterns

The price is still being confined to a smaller and smaller area over time, but it is reaching a similar high point each time the low moves up. An ascending triangle can be drawn once two swing highs and two swing lows can be connected with a trendline. A descending triangle is formed by continuously lowering swing highs over time, and swing lows that reach similar price levels as the last lows. When a trendline is drawn along the similar swing lows, it creates a horizontal line. The trendline connecting the falling swing highs is angled downward, creating a descending triangle figure three.

The price is being confined to a smaller and smaller area, but it is reaching a similar low point on each move down. A descending triangle can be drawn once two swing highs and two swing lows can be connected with a trendline. In the real world, once you have more than two points to connect, the trendline may not perfectly connect the highs and lows.

- w2 box 14 stock options.

- Related Topics?

- forex services nagpur;

That is okay; draw trendlines that best fit the price action. The breakout strategy can be used on all triangle types. The execution is the same regardless of whether the triangle is ascending, descending or symmetrical. The breakout strategy is to buy when the price of an asset moves above the upper trendline of a triangle, or short sell sell the asset before it hits a lower price, intending to buy it back even lower when the price of an asset drops below the lower trendline of the triangle.

Breakout refers to a market situation where prices move above resistance levels or below support levels. These breakouts are used as indicators of opportunities for traders.

- forex ethereum.

- forex display.

- forexmart contest;

Since each trader may draw their trendlines slightly differently, the exact entry point may vary between traders. To help isolate when the price is breaking out of the support or resistance levels, observing an increase in volume can help highlight when the price is starting to gain momentum towards a breakout. The objective of the breakout strategy is to capture profit as prices move away from the trend lines forming the triangle.

If the price breaks below triangle support lower trendline , then a short trade is initiated with a stop-loss order placed above a recent swing high, or just above triangle resistance upper trendline. It helps to have exit strategies in place when purchasing, so you can sell when it is the right time based on your criteria. To exit a profitable trade, consider using a profit target.

A profit target is an offsetting order placed at a pre-determined price. One option is to place a profit target at a price that will capture a price move equal to the entire height of the triangle. Profit targets are the simplest approach for exiting a profitable trade since the trader does nothing once the trade is underway.

Types of Forex Chart Patterns

Eventually, the price will reach either the stop-loss or profit target. The problem is that sometimes the trade may show a nice profit, but not reach the profit target. Traders may wish to add additional criteria to their exit plan, such as exiting a trade if the price starts trending against their position.

More advanced forms of the breakout strategy are to anticipate that the triangle will hold and to anticipate the eventual breakout direction. By assuming the triangle will hold, and anticipating the future breakout direction, traders can often find trades with very big reward potential relative to the risk. For instance, assume a triangle forms and a trader believes that the price will eventually break out to the upside.

In this case, they can buy near triangle support the bottom of the low , instead of waiting for the breakout. This creates a lower entry point for the trade; by purchasing near the bottom of the triangle the trader also gets a much better price. Placing a stop-loss just below the triangle reduces the amount of risk on the trade. If the price does break out to the upside the same target method can be used as the breakout method discussed above.

Because of the lower entry point, the trader that anticipates stands to make much more than the trader who waited for the breakout. If a trader thinks the price will eventually break below the triangle, then they can short sell near resistance and place a stop-loss just above the triangle. By going short near the top of the triangle the trader gets a much better price than if they waited for the downside breakout. This is because it is on the third or later touch of support or resistance that the trader can generally take a trade—peaks and troughs generally run in series of three.

The first two price swings are only used to actually draw the triangle. Therefore, to establish the potential support and resistance levels, and take a trade at one of them, the price must touch the level at least three times. The trade shown in figure four would not work for an anticipation strategy since the price broke higher before coming back to touch the recently drawn support line.

Figure five, on the other hand, shows the anticipation strategy in action. You should always utilize a stop-loss. Even if the price starts moving in your favor, it could reverse course at any time see false breakout section below. Having a stop-loss means most of the risk is controlled. The trader with a stop-loss exits a trade with a minimal loss if the asset doesn't progress in the expected direction. Having a stop-loss in place also allows a trader to select their ideal position size. Position size is how many shares stock market , lots forex market or contracts futures market are taken on trade.

To calculate the ideal position size, determine how much you are willing to risk on one trade. Once you know the amount you can risk, take the difference between your entry and stop-loss prices.