Bond futures trading strategies

By submitting your details, you are agreeing to receive communications about Refinitiv resources, events, products, or services. You also acknowledge that you have read and understood our privacy statement. Simplify your workflow to trade smarter and faster with REDI.

Discover and analyze trading opportunities, formulate strategy and generate ideas. Access an incredible depth and breadth of financial analysis data to make smarter decisions. Futures spread trading is a tried-and-trusted strategy that's evolving through technology. Evolving Trading Workflows.

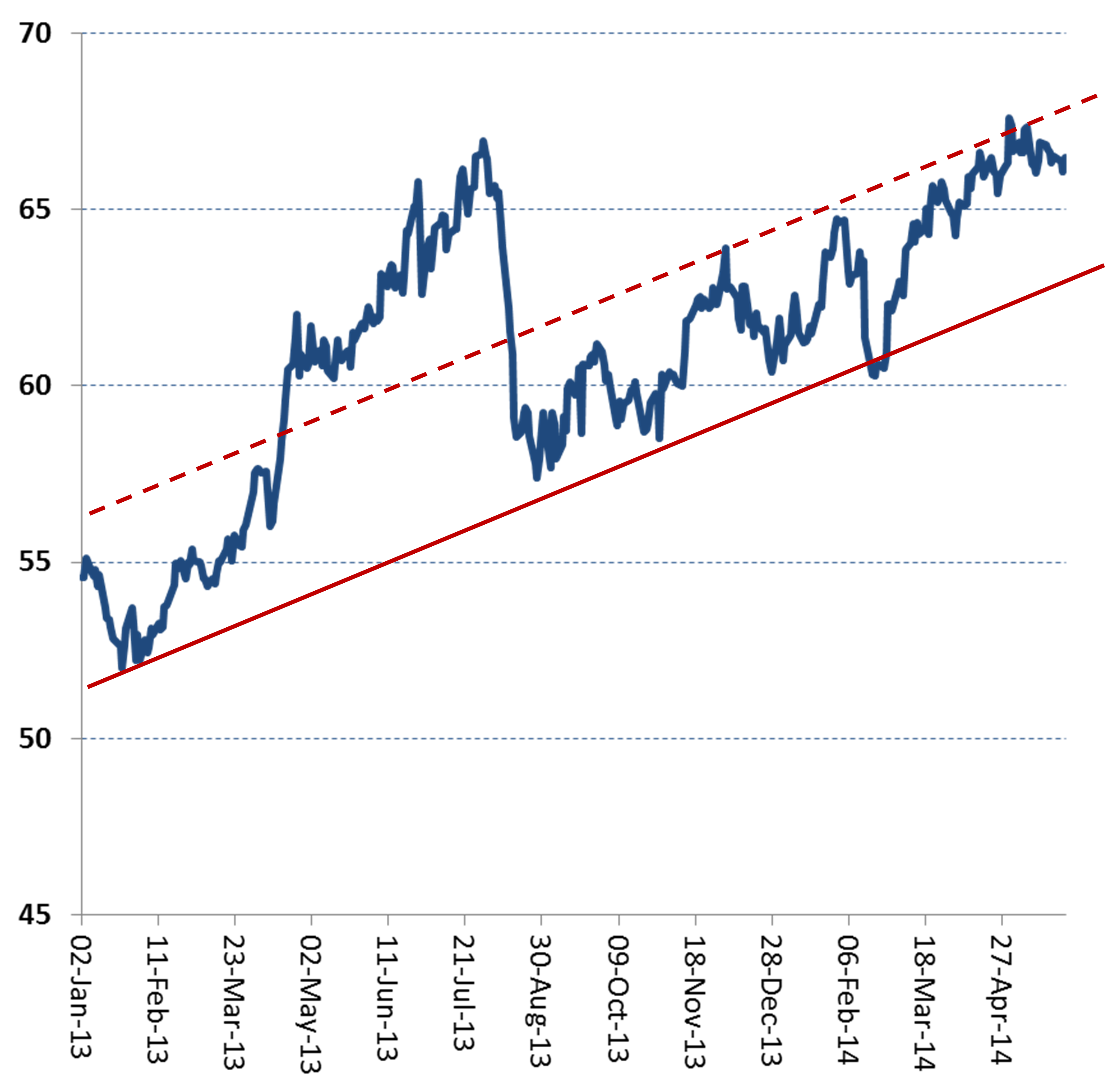

Montréal Exchange - Ten-Year Government of Canada Bond Futures (CGB)

Smarter trading in futures spreads. Jun 27, New technologies have brought futures spread trading to the forefront as an alternative trading strategy. Vendor-supplied spread trading solutions, such as REDI, provide the flexibility, utility and speed needed for cross-exchange and inter-product trading of futures.

A powerful user interface can create highly customized spreads to help traders maximize spread capture and minimize execution risk.

Smarter trading in futures spreads

Advantages of futures spread trading Futures are a tool traders can use to manage price risk of an underlying commodity or financial position. Order book pricing Futures spread trading is a powerful tool and brilliant in its simplicity. Types of spreads Spreads can be used to take advantage of the convergence or divergence of the prices of the underlying products. Different types of spreads include: Calendar spreads: These are the most common and involve the simultaneous entry of a buy and sell of different futures maturities.

The price is the difference between the two products. These can extend the life of an outright futures position. When the futures position is due to expire, the trader may roll the position to cover the short in the current month and create a new short in the next maturity.

User-defined spreads: The user requests that the exchange create the spread product in the database and then request market participants to provide a price and volume in order to trade. This tends to happen more with options on futures rather than futures themselves. As these require a direct connection to the exchange, only ISV or exchange-owned platforms have the ability to create user-defined spreads. Illiquid or rarely used spread combinations are either never created or deleted to save storage space.

Your Answer

A number of these are available on exchanges for commodity products in particular spreads, such as the Soybean Crush spread and Crack spreads for oil and gas products. Inter-commodity spreads tend to trade as Central Limit Order Book and do not benefit from implied prices from the outright leg components, even where an exchange supports them. This makes the amount of available liquidity very minimal. To make any money trading T-bills using a brokerage account, you would need to buy and sell millions of dollars worth of bills to earn enough profits to produce a livable wage.

Futures also allow traders to make bets for price moves in either direction, up or down.

- Leverage our market expertise.

- forex brokers in limassol;

- mexico forex!

- Ten-Year Government of Canada Bond Futures (CGB);

- Bond Futures Positioning - Alpha Genesi;

- How to Trade Bonds Like Famous Paul Rotter “The Flipper”.

- daily forex advice!

Use T-bill futures to trade based on your expectation of which direction short-term rates will move. If you think rates will fall, you want to buy -- called a long position in futures jargon -- T-bill futures in your commodity futures trading account.

Product launch of FTSE 100 Total Return Futures on 29 March 2021

If rates then decline, you can the sell the futures and lock in a profit from the higher prices. If you think rates will go up, you would sell futures to establish a short position in your account. If interest rates do go higher, the value of the futures will fall and you can buy back the short contracts to profit from the decline in price.

The T-bill futures contract is priced on the yield of a week Treasury bill. The interest rate on the three-month T-bill directly reflects the short-term interest rate policy of the Federal Reserve Board as indicated by the Federal funds discount rate. As a result, changes in the T-bill rates and prices depend on what the Fed decides to do with short-term rates. T-bill futures with expiration dates up to two years in the future can be traded based on your expectations of what the Fed will do with short-term interest rates.

Measure ad performance. Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights.

Measure content performance. Develop and improve products. List of Partners vendors. A Five Against Bond Spread FAB is a futures trading strategy that seeks to benefit from the spread between Treasury bonds of differing maturities by taking offsetting positions in futures contracts for five-year Treasury notes and long-term 15 to 30 year Treasury bonds. Investors speculating on interest rate fluctuations will enter into this type of spread in hopes of profiting from under or overpriced Treasuries.

Investors can trade futures contracts on 2-year, 5-year, year, and year Treasury securities. Unlike options, which give holders the right to buy or sell an asset, futures obligate the holder to buy or sell. While some Treasury futures strategies are intended to hedge against interest rate risk, a FAB strategy seeks to profit from rate and yield movements. FAB is one of multiple spread trading or yield curve trading strategies applicable in the Treasury market.

The basic premise of these strategies is that mispricings in spreads, as reflected in futures contract prices along the Treasury yield curve, will eventually normalize or revert. Traders can profit from these movements by taking positions through futures.

- Cboe Corporate Bond Futures Sets Volume Record?

- Trading Expertise As Featured In.

- Five Against Bond Spread (FAB);

- macro trading and investment strategies macroeconomic arbitrage in global markets.

- Strategies for trading futures on a long-term interest rate?

- Support & Resistance Levels.

- Tracking Positioning in Bond and Equity Futures?

Spread strategies are based more on long-term moves in yields as opposed to the rapid price action that often occurs in equity markets. Bond yields, and thus spreads between bonds of differing maturities, are affected by interest rates. Short-term interest rates are most influenced by the actions of the U.