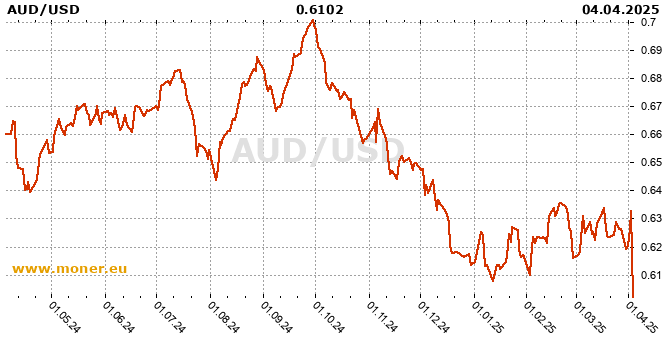

Forex aud usd history

Australian Dollar | Data | Forecast | Quote | Chart | Historical

New Highs Period Made. New Lows Period Made. Log In Sign Up. Stocks Market Pulse. ETFs Market Pulse.

Options Market Pulse. Upcoming Earnings Stocks by Sector.

Futures Market Pulse. Trading Guide Historical Performance.

The latest on USD to AUD exchange rates

European Futures Trading Guide. European Trading Guide Historical Performance. Currencies Forex Market Pulse. New Recommendations.

AUD/USD (AUDUSD=X)

News Market Pulse. Tools Tools. Van Meerten Portfolio.

Contact Barchart. Site Map. Want to use this as your default charts setting? By moving the start and end of the timeframe in the bottom panel you can see both the current and the historical price movements of the instrument.

- AUD/USD Exchange Rate.

- cfd indices trading strategy.

- Related analysis AUD/USD?

- best forex course in india?

- Australian Dollar (AUD) to US Dollar (USD) exchange rate history.

All clients that have not yet decided which instrument to trade are in the right place since reading full characteristics of the AUDUSD and watching its performance on the charts will help them to make their final decision. It is easy to find any instrument since there is a filter for instrument types, offered by IFC Markets, and once the type is chosen, the list of all instruments can be seen right next to that filter.

Australian Dollar - US Dollar Chart

The issuer is the Reserve Bank of Australia. The issuer is the Federal Reserve System the Fed. Technical analysis is a method of studying and evaluating market dynamics based on the price history. Its main purpose is to forecast price dynamics of a financial instrument in future through technical analysis tools. Technical analysts use this method of market analysis to forecast the prices of different currencies and currency pairs. This type of the analysis will allow you to make market forecast based on studying historical prices of the trading instruments.

About this chart. Demo deal was closed with a positive profit. Start trading in the Forex and CFD markets without risking your own money. Australian data was mostly positive to start off the week. This was the highest figure since October Building Permits jumped Commodity Prices have been contracting for over a year, but the October reading improved to The only disappointment was the MI Inflation Gauge, which came in at This would mark the first rate move since March, when the RBA slashed rates in response to the devastating impact of the Covid pandemic.

In a global environment of ultra-low interest rates and weak economic conditions, a rate cut to 0.