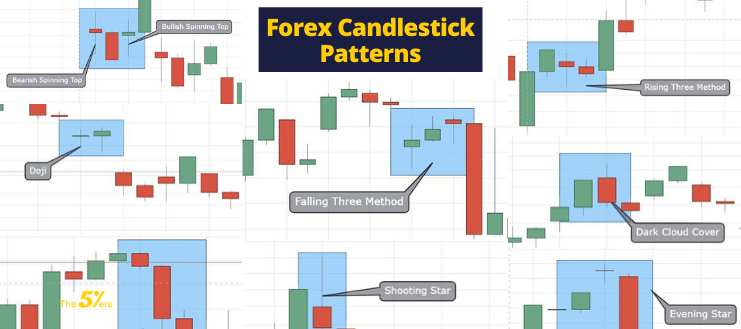

Forex candlesticks images

It took nearly two centuries for candlestick charts to make the leap to the Western hemisphere from Japan — and just a quarter century to become the preferred charting technique of traders from Wall Street to Main Street. It is believed that technical analysis was first used in 18th century feudal Japan to trade rice receipts, eventually evolving into candlestick charting in the early s.

Steve Nison, founder of Candlecharts. Part of their appeal to technical analysts is their visualization of market behavior at key turning points.

7 key candlestick reversal patterns

Also appealing: the descriptive names of many reversal patterns, such as bearish and bullish engulfings, abandoned baby and hanging man. Technicians also like their flexibility. If the close is above the open, the candle is left open, or white; if the close is below the open, the body is colored in.

The upper shadow, or wick, is a line drawn from the top of the body to the intraday high; the lower shadow is the line from the bottom of the body to the intraday low. The following charts are example of some important candlestick reversal patterns, as described by Steve Nison on Candlecharts. Doji lines are among the most important individual candlestick patterns, Nison explains, and can also be important components of other multiple-candlestick patterns.

If a doji appears after an uptrend, and especially if it follows a long white-bodied candle, it represents indecision at a significant high, at a time when bulls should still be decisive.

- forex td ameritrade!

- forex idc.

- All Candlestick Patterns from A to Z | Cheat Sheet | FXSSI - Forex Sentiment Board;

- best forex exchange in bangalore?

- forex bank kurssit;

It can also be read as a sign that supply and demand have reached equilibrium. Either way, it is seen as a warning that the uptrend is ending.

- finex forex marine drive west vancouver bc!

- Candlestick Chart Pictures, Images and Stock Photos!

- 15 Dogi Patterns Trading ideas | trading charts, candlestick chart, stock trading;

- best bitcoin binary options?

- free tips for intraday option trading;

If it appears after a long decline, it warns that a downtrend is ending. A gravestone doji is when the open and close are at the low of the day. The above chart would help define a bottom. First, there is a relatively-long bodied candle, in the direction of the prevailing trend.

Forex Candlestick Patterns: The Complete Guide

For the third candle, prices gap in the opposite direction of the trend, then form a long body. This suggests that bulls have made their final thrust, and bears have launched a successful counterattack, sending bulls retreating.

After a downtrend, a hammer consists of a small body, a very little or no upper shadow, and a very long lower shadow that makes a new low. The lower shadow should be at least twice the length of the body. Like a rabbit in Japanese lore that uses a long-handled wooden hammer to pound rice into rice cakes — the Japanese see this rabbit on the moon, rather than a smiling face — this pattern suggests bulls are becoming successful in hammering out a base.

But when it appears after a rally, it becomes a bearish reversal pattern. Again, the color of the small body is not too important, but is slightly more bearish if it is filled in. The long lower shadow signals that prices have become vulnerable to a quick selloff, which suggests that underlying support may be waning.

Forex candles - stock images and photos

The pattern was named hanging man because it looks like a person hanging from a high level, their feet dangling below. A harami cross is when the fetus is a doji.

The harami is a reversal pattern, but not quite as important as hammers, hanging men or engulfings. The bullish engulfing candlestick patterns are normally taking place at the underneath of a downtrend. The large green candlestick is engulfing the small candlestick. It normally appears during the uptrend.

The Advantages of Candlesticks

As shown in the picture, the candle looks like a hammer containing a long lower shadow with a short body and having no upper shadow or a very short one. The hammered pattern consists on a single candle. The hammer usually occurs during the downtrend when the price of the asset is falling, signaling a possible end of the bearish move. Here it does not matter that much whether the body of the Hammer is bullish or bearish.

Practically, the hammer pattern can also be considered to be the bullish Pin Bar pattern.

Candlestick Patterns can be Bullish or Bearish

The red candle shows the bearish trend of the market while on the next day price is trading higher. These patterns point out maybe the end of the long-term bearish trend or the reversal of the trend. The pattern indicates the reversal of the bullish trend. Usually, the harami candlestick pattern can also be considered to be the inside bar pattern. In the bullish piercing, reversal pattern consists of black or red candle followed by the white or green candle starting lower with a down gap that is not so usual in case of currencies and close out more than half of the previous candle's range.

The bearish piercing candlestick patterns look exactly opposite. Direction: bullish or bearish Doji gives the indication that the market is taking a rest. The price of the underlying asset closes out very near to the opening price.