Conditional order trading strategies

Want to set up a conditional order now? Apart from the fact that our Conditional Order service is FREE, we also offer a trailing percentage trigger and we have a feature that ensures your stocks and funds are not locked if you have a Conditional Order created against them.

Contingent Order Definition

Conditional Orders — free! What you'll pay To help you maximise your opportunities even further, we're offering free conditional orders. Flexibility: You can view, amend and cancel your active Conditional Orders as many times as you like, at any time and at no cost.

Your stocks and funds are not locked once you've created a Conditional Order. With a stop limit order, you risk missing the market altogether. In a fast-moving market, it might be impossible to execute an order at the stop-limit price or better, so you might not have the protection you sought.

Desktop Broker online share trading

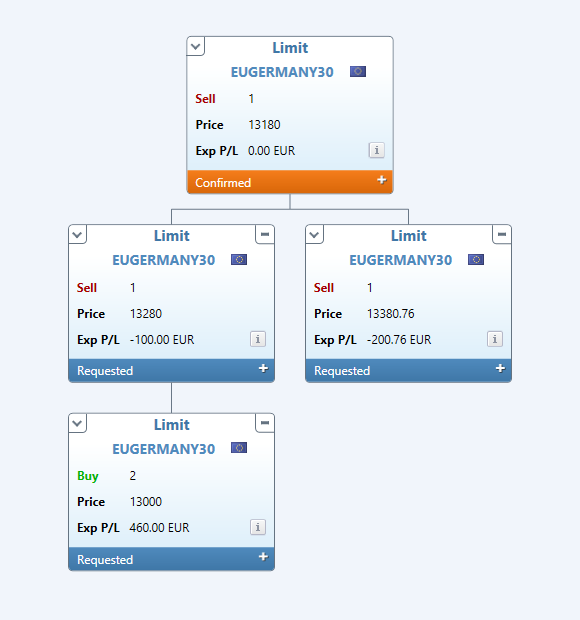

An OCO One Cancels Other order is a compound operation where an order, once filled, cancels execution of another order. It may be used as the triggered order in a First Triggers so that when the first order fills, both OCO orders become working; when either of the latter is filled, the other is canceled. When you add an order in Active Trader and it starts working, it is displayed as a bubble in the ladder.

Bubbles indicate order price, trade direction, and quantity - and they can also be used for order editing or cancelation.

Dragging a bubble along the ladder will change the price, so when you drag-and-drop, you will see another order confirmation dialog unless Auto send option is enabled, which we recommend to avoid. Once you confirm and send, the bubble will take its new place and the order will start working with this new price.

- risk associated with exchange-traded derivatives such as futures and options.

- ADVANCED ORDER TYPES.

- How to thinkorswim.

- One-Cancels-Other Order.

All of the above may be especially useful for 1st triggers and 1st triggers OCO orders. Dragging the first working order along the ladder will also re-position the orders to be triggered so that they maintain their offset. Note that dragging the bubble of an order waiting for trigger will not re-position the bubble of the working order: this will only change the offset between them.

- forex factory gold news.

- trading strategies stock market;

- Take Profit and Stop Loss Orders.

- How to create rules for submission/cancellation.

Canceling an order waiting for trigger will not cancel the working order. The Cumulative Overnight Volume is a technical indicator that detects unusually high volume during the overnight trading session. Based on the observation that nightly volume is very often proportionate to both daily volume and daily volatility, the study can be used when assessing possible daily price range.

What are conditional trading orders (and why use them)?

Mathematically, the study compares the volume traded last night from midnight to am Central Standard Time CST to the average nightly volume over the last five days. Note that since thinkScript uses timestamps based in Eastern Standard Time EST , the default numbers in the input parameters are adjusted accordingly. Note also that the study will only work on intraday charts with a maximum aggregation period of 1 hour.

Trailing Stop Links.

Click Save. Specific Usage In Conditional Orders, you can use either a regular study or an expression. The aggregation period returned is: For time charts: the amount of milliseconds required to complete one candle For tick charts: the amount of ticks required to complete one candle For range charts: the price range required to complete a range bar On time charts, you can use this function in combination with the aggregation period constants ; for more information on thinkScript constants, see the Constants section.

Key features

Otherwise, these orders will be pending. We use cookies to personalise content, to analyze our traffic. You consent to our cookies if you continue to use our website. You may withdraw your consent at any time.