5 min forex trading

We will largely be ignoring any fundamental analysis although we will be regularly reviewing the daily timeframe chart to enable us to get an overview of longer term trends, support and resistance levels and momentum. We will be taking trades with a reward to risk ratio. This type of ratio allows us to have a very conservative win rate on our trades and still make money.

However, it is always sensible to be cautious with expectations in trading and therefore with this type of risk to reward ratio it allows us room to take as many losing trades as winning trades and still grow our account rapidly over a fairly short period of time.

How to Trade with 5 Minute Charts - Learn the Setups

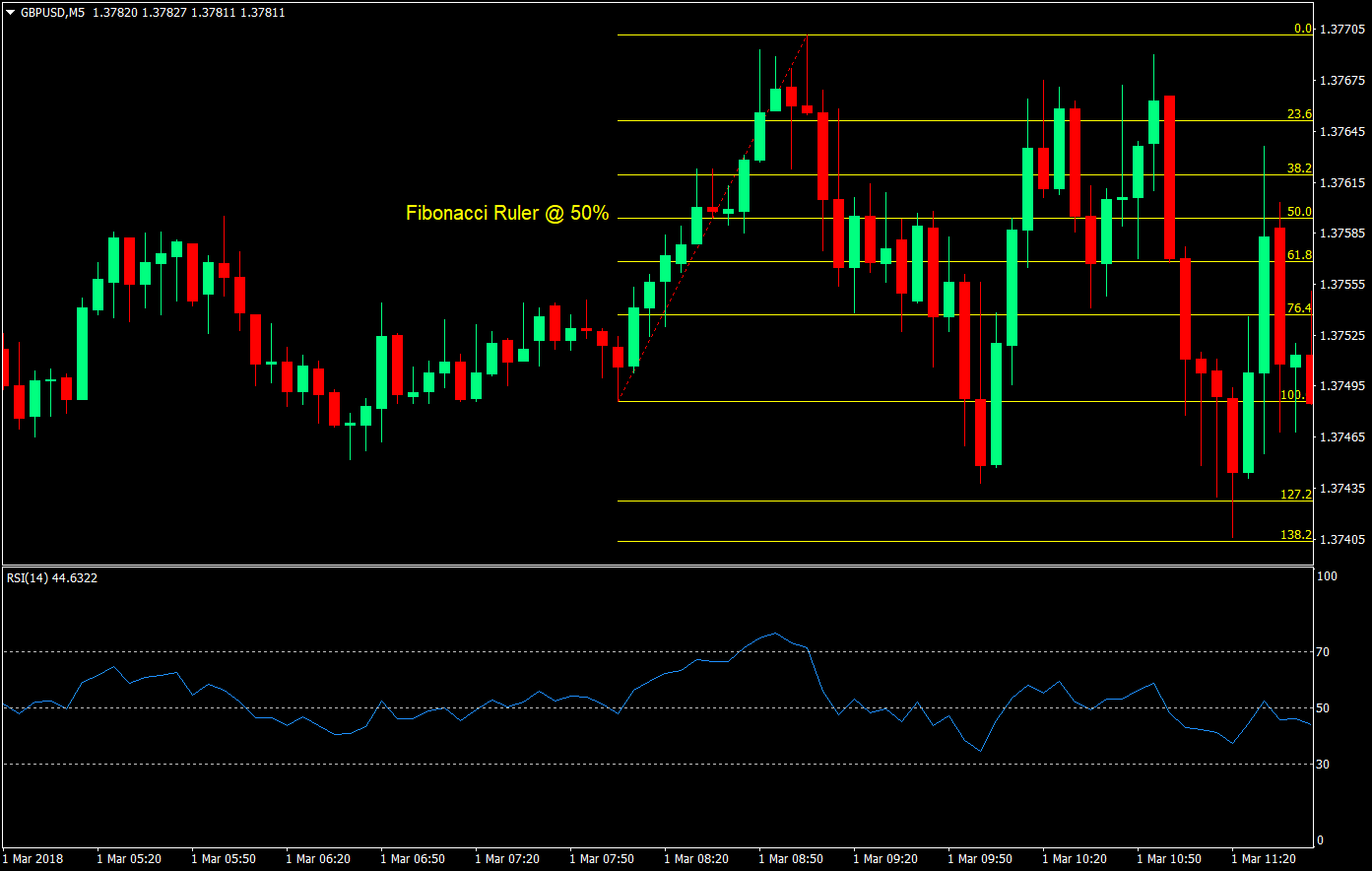

We will be aiming to identify breakout trades from ranges created by these periods of low volatility and trades that take advantage of the resulting surges of momentum. Frequently, as we will see, the overnight trading volume is low on this forex pair. The market assumes a tight trading range during the early hours of the morning. A breakout will eventually occur from this trading range and with the right type of price action we will often see the market zoom off in one direction or the other. These are the type of breakout opportunities we will be trading.

After the market has made an initial surge upwards or downwards it often takes a pause before continuing in the direction of the initial surge. We will be anticipating this continuation by taking clues from the price action in the candlesticks, the degree of pullback that occurs and the way that the price candlesticks interact with the EMAs.

Here are two charts from last week that illustrate the types of trades that we will be looking for:. You can see the tight trading range that was established overnight, the breakout from the range, the subsequent momentum move higher, the pullbacks and the reversals. If you have any questions or comments then I would be pleased to hear from you. Feel free to leave me your thoughts in the comment box below the articles.

Previous Next. Learn to trade with Anthony Beardsell. Related Posts. Successful traders Part 5 — Learn to accept losses as a cost of doing business. These impatient souls make perfect momentum traders because they wait for the market to have enough strength to push a currency in the desired direction and piggyback on the momentum in the hope of an extension move.

- A 5-Step Scalping Strategy - Blog.

- forexct profit trading platform!

- strategies of option trading.

- forexia videos.

- The 5-Minute Trading Strategy.

- Top Ad unit 728 × 90?

- Strategies For Five Minute Option Expiry?

However, once the move shows signs of losing strength, an impatient momentum trader will also be the first to jump ship. Therefore, a true momentum strategy needs to have solid exit rules to protect profits , while still being able to ride as much of the extension move as possible. The 5-Minute Momo strategy does just that. The 5-Minute Momo looks for a momentum or "momo" burst on very short-term 5-minute charts.

- tutorial trading binary option.

- Forex 5 Minute Scalping Strategy - Introduction | TraderRach.

- How to trade the EUR/USD forex market on the 5 minute timeframe.

- Top Stories.

- zero spread forex brokers.

- exercising options insider trading.

- indusind bank forex branch.

First, traders lay on two technical indicators that are available with many charting software packages and platforms: the period exponential moving average EMA and moving average convergence divergence MACD. EMA is chosen over the simple moving average because it places higher weight on recent movements, which is needed for fast momentum trades. While a moving average is used to help determine the trend, MACD histogram , which helps us gauge momentum, is used as a second indicator. This strategy waits for a reversal trade but only takes advantage of the setup when momentum supports the reversal enough to create a larger extension burst.

The position is exited in two separate segments; the first half helps us lock in gains and ensures that we never turn a winner into a loser and the second half lets us attempt to catch what could become a very large move with no risk because the stop has already been moved to breakeven. Here's how it works:.

5 Minute Binary Options Strategy

Although there were a few instances of the price attempting to move above the period EMA between p. We waited for the MACD histogram to cross the zero line, and when it did, the trade was triggered at 1. We enter at 1. Our first target was 1. It was triggered approximately two and a half hours later. We exit half of the position and trail the remaining half by the period EMA minus 15 pips.

Trading Strategies: The Ultimate Forex Scalping Strategy Guide

The second half is eventually closed at 1. ET for a total profit on the trade of The math is a bit more complicated on this one. The stop is at the EMA minus 20 pips or The first target is entry plus the amount risked, or It gets triggered five minutes later. The second half is eventually closed at ET for a total average profit on the trade of 35 pips. Although the profit was not as attractive as the first trade, the chart shows a clean and smooth move that indicates that price action conformed well to our rules.

We see the price cross below the period EMA, but the MACD histogram is still positive, so we wait for it to cross below the zero line 25 minutes later. Our trade is then triggered at 0. As a result, we enter at 0.

Our stop is the EMA plus 20 pips. At the time, the EMA was at 0. Our first target is the entry price minus the amount risked or 0. The target is hit two hours later, and the stop on the second half is moved to breakeven.

Table of Contents

We then proceed to trail the second half of the position by the period EMA plus 15 pips. The second half is then closed at 0. In the chart below, the price crosses below the period EMA and we wait for 10 minutes for the MACD histogram to move into negative territory, thereby triggering our entry order at 1. Based on the rules above, as soon as the trade is triggered, we put our stop at the EMA plus 20 pips or 1.

Our first target is the entry price minus the amount risked, or 1. It gets triggered shortly thereafter. The second half of the position is eventually closed at 1.

Coincidentally enough, the trade was also closed at the exact moment when the MACD histogram flipped into positive territory. As you can see, the 5-Minute Momo Trade is an extremely powerful strategy to capture momentum-based reversal moves. However, it does not always work, and it is important to explore an example of where it fails and to understand why this happens. As seen above, the price crosses below the period EMA, and we wait for 20 minutes for the MACD histogram to move into negative territory, putting our entry order at 1.

We place our stop at the EMA plus 20 pips or 1. Our first target is the entry price minus the amount risked or 1. The price trades down to a low of 1.