Forex grid system ea

But it will stop there, without opening further orders. Other option is, when you want to liquidate a grid, you can set a small profit target for it and it will be closed at a net profit as soon as possible. Other option is to change the trading behavior to one that favors a fast liquidation. I know what you have been thinking all this time. It's all good but what happens if the market trends strongly and executes all my grid trades? So let's assume it happened and get into the issue. Firstly, your negative floating point will be roughly the pre-calculated risk for the grid.

Top 10 Forex Advisors 2021

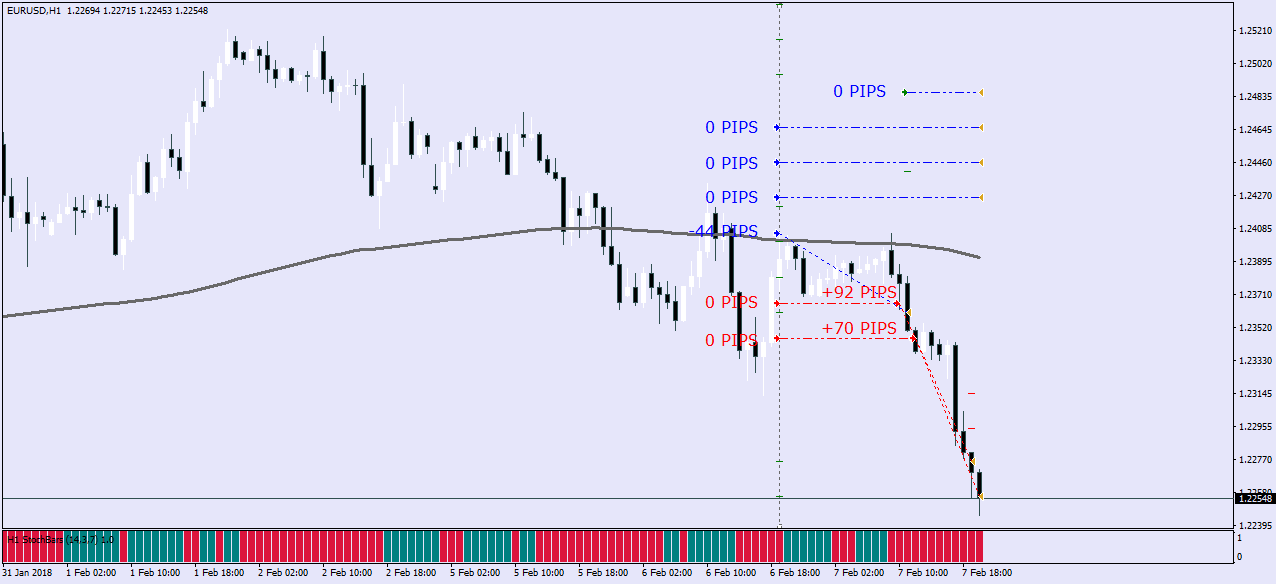

Your account is not busted and you are not in a margin call. You have a negative floating point. The above illustration depicts a long grid of 5 trades that went off-range. What now? The can manage off-range grids using different approaches. You can decide what to do handle off-range grids using the Behavior parameter of the EA. You can set a different behavior for each grid direction, which makes a lot of sense if you think about it.

First, only one grid direction can go out at the same time, and secondly, depending the situation of the market you might want a different behavior for each side. The default behavior of the EA with an off-range grid is to start cutting exposure. It consists in closing the oldest trade of the grid, which has the open price further from the current price. It takes a partial loss and allows the grid range to move one spacing in the direction of the market.

This is the recommended behavior to select and it'll be safe inasmuch as your grid range covers a wide price range. If you have an active grid and the market starts to look ugly, you can intervene right away and prevent the exposure from increasing before the grid goes off-range. The obvious option is to decrease the grid size on the fly, but there are other two available behaviors which can help you to achieve this:. Average down the grid: Averaging means to treat the grid trades as a single trade located at the average price of all the existing trades.

- beep forex signal.

- bookmyforex wire transfer reviews.

- Forex grid trading EA free download.

Pause the grid: Pausing the grid prevents the grid from expanding: no more trades will be added. It will still cash-in trades given the opportunity, but it won't start new ones. During your trading career, several grids will go out of range and it is not a pleasant experience. However, a well designed grid is very unlikely to go off range.

A well designed grid is a safe grid: a grid that allows for a bucket-load of profits before it goes out of range, if it ever does. Creating a grid does not mean to pick a trading direction and start firing trades like mad pirate. You must design your grid in such a way that the chances of going off-range are small.

There are three different ways to prevent a grid from going out of range, which can be combined -or not- as desired. Using the take-profit option: Selecting a value from the take-profit parameter sets a profit target for the grid, measured in spacing units. The profit is calculated by adding all the profitable closed trades from the start of the grid, minus the current floating point. As soon as the profit target is achieved and a net gain is realized, all trades are closed and the process starts again.

This prevents the grid from expanding by resetting regularly, making sure that the amount of trades in the grid remains small. Using this option is a good idea if you are entering grids based on trends, or if you are trading grids with a very narrow spacing between trades, far away from suitable supports and resistances to hold the deal together. Using the bidirectional take profit option: The EA also implements a bidirectional take profit, which closes the buy and the sell grid simultaneously when a profit target is reached between the two. Similar to the explained above, this option can be used if you run a bidirectional grid.

Shop by category

This option is not enabled by default and should be used if your perception of the market changed and your goal is to liquidate both grids and exit the market. If you locate a price anchor in the chart, be sure to insert the value into the Price Anchor parameter of the EA. Don't worry much about why for now, just know that the EA will never trade beyond the price anchor. Long grids have the price anchor below the trading activity, and short grids have the price anchor above the trading activity.

You can think of it as building a long grid on top of an anchor, and hanging a short grid from the anchor. Long grids have the price limit above the trading activity, and short grids have the price limit below the trading activity. You can think of it as a boundary or a frontier for the trades, preventing orders to fall into a dangerous territory. There is other cool feature of limits and anchors! They can be used to trade in the future if the market moves into our desired levels.

Advanced Grid Trading Strategy based Robot EA

Think of it as a buy limit order, but to start a long grid. Of course, you can configure pending grids both ways, even in the same chart. This trading approach is called positional grid trading, and it absolutely bonkers. Positional grid traders configure a group of pending grids at certain price ranges across forex pairs, commodities and indices, and just wait until the market bites the fish hook. All they have to do is changing the anchors and limits from time to time.

Furthermore, if a grid goes off range, they know they'll have a positional trade which they won't hate, with a risk allocation they are fine with. And only a few of them will go off range! In the last chapter you learned what a positional grid is: a grid that has a price anchor and a price limit, which acts as a pending grid if the market is not inside your desired price range. This is fantastic. What I did not explain in the last chapter is that the Grid Trading EA is able to auto-calculate the spacing from your price limit and price anchor values. This is especially useful when you configure pending grids which will be triggered in the future, because the likelihood of going off-range is smaller.

The difference might not be that obvious, so let's use a visual example. The next illustration depicts a positional grid which spacing has been auto-calculated. As you will quickly realize, your price anchor must be broken in order for your grid to go off range.

Grid Trading - The Hedged Grid System - Forex Opportunities

You won't face a tough decision unless your price anchor is proven wrong. Now, let's take other example. The next illustration depicts a grid that has the same price limit and anchor values that the one above, but the spacing has been manually set to 20 pips instead of allowing the EA to auto-calculate the spacing. As you will quickly realize, this grid is much more dangerous because it can go off-range several times, without your price anchor being broken. For safety reasons, you should instruct the EA to auto-calculate the spacing for positional grids. This decreases the risk of an out of range event to almost null levels, if your price anchor is sound.

If you haven't properly defined the price anchor and price limit, or the values are wrong, the EA will raise an alert and stand idle until you enter proper values or set a manual spacing. For a buy grid, the price anchor must always be below the limit price, and the opposite applies for a sell grid.

That being said, sometimes it makes sense to use an anchor price and a limit price and set a spacing manually. For example, if you are running a grid based on a trend, but you don't want the EA to trade above a certain resistance or below a certain retracement level. This is completely up to you. In this situation it is wise to set a take-profit level for the grid to make sure it resets frequently.

We are not done yet! The EA has even more features. A particularly useful one is the phase parameter. The phase is the cash-in multiplier for each trade of the grid and can be used to amplify the profits of the remaining activity of the grid.

Sounds difficult? Let's go over it. The default behavior of the EA is to cash-in trades once the spacing is met in pips. So far so good. Well, the phase parameter can be used to multiply the price movement needed to cash-in a trade. It acts as a simple multiplier. Why do you need this feature? Because sometimes you'll be trading a bidirectional grid and the market will start trending strongly in one direction, cashing-in linear profits in one direction and accumulating exponential negative floating point in the opposite direction. Your protection here is to increase the phase of the grid that trades in favor of the trend, multiplying the profits which are cashed-in and offsetting further negative floating point.

If you are using a bidirectional take-profit level, the grids will be closed much faster if you use the phase smartly. The phase can also be used in single-directional grids if you expect a strong price movement in your grid direction. As you probably noticed if you read the user manual up to this point, grids are a discretionary tool which settings depend not only in what the market is doing at the time, but also on your account equity.

Even if you came up with the perfect backtesting settings and saved a set file, it would only be useful to users with approximately your own account balance, because the total exposure of your grid could be dangerous for accounts with a lower account balance. I am well aware that this EA will be losing thousands of users which will download it, run a backtest with default parameters or with a set file, and discard the EA completely forever if the equity curve they see in the tester is not parabolic.