Rsi forex formula

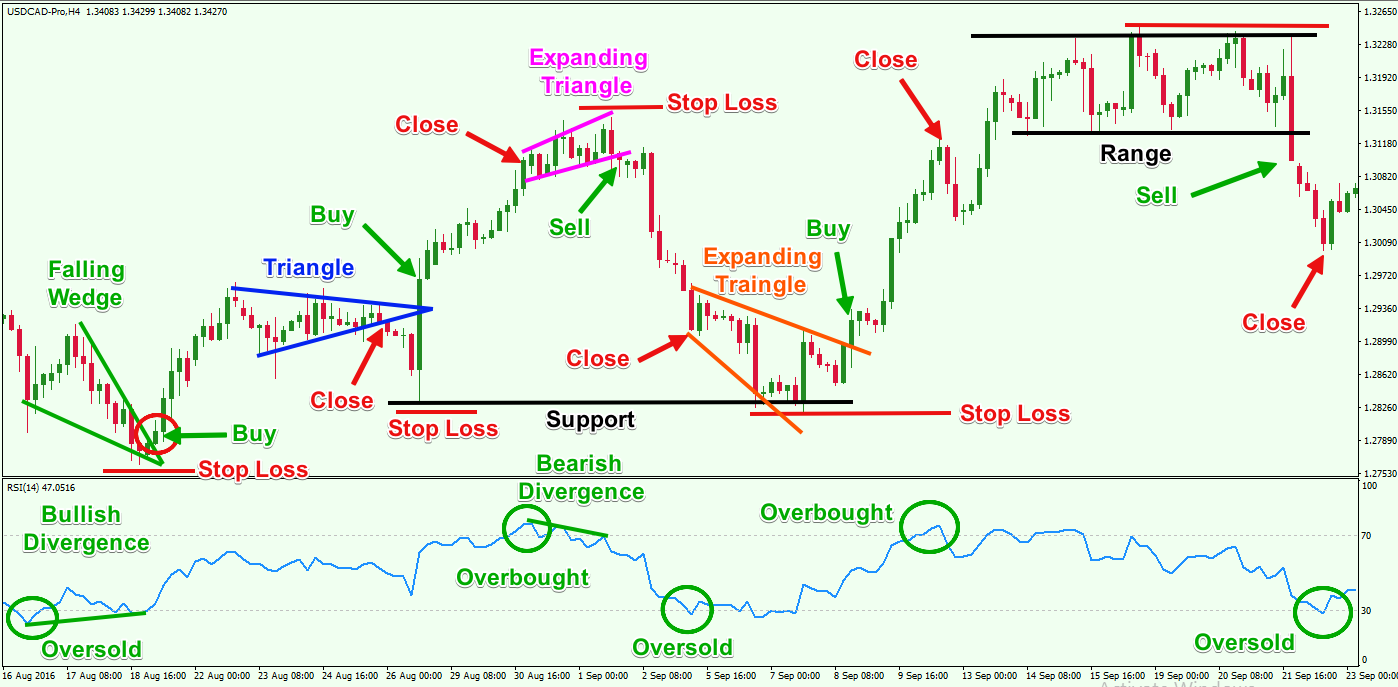

In an uptrend, the RSI is usually above 50, while in a downtrend, it is below Past performance is not necessarily an indication of future performance. With the RSI 14, there are times when the market does not reach the oversold or overbought levels before a shifting direction occurs.

RSI definition

A shorter period RSI is more reactive to recent price changes, so it can show early signs of reversals. A buy signal is then generated, and a 5 vs. This is a sell signal. Experienced traders may find that their trading performance greatly benefits from combining an RSI trading strategy with Pivot Points. Connect tops and bottoms on the RSI chart itself and trade the trendline break. A down trendline is drawn by connecting three or more points on the RSI line as it falls.

Determining the Trend using RSI

The break of an RSI trendline might indicate a potential price continuation or a reversal. Bear in mind that the break of an RSI trendline usually precedes the break of a trendline on the price chart, thus providing an advance warning, and a very early opportunity to trade. RSI bearish divergence forms when the price forms a higher high, and at the same time the RSI decreases, and forms a lower high. You will usually see RSI divergence forming at the top of the bullish market, and this is known as a reversal pattern.

Traders expect the reversal when the RSI Divergence forms. It is an advance reversal warning, as it appears in several candlesticks before the uptrend changes its direction, and breaks below its support line. This is an advance warning sign that the trend direction might change from a downtrend to an uptrend.

Relative Strength Index (RSI): You Want to Study It For These Buy or Sell Signals -

RSI divergence is widely used in Forex technical analysis. Using these strategies, you can achieve various RSI indicator buy and sell signals. Along with strategy and settings, we can combine other technical indicators to complement the RSI when using the RSI indicator for day trading. Some of the best ones are momentum indicators. We recommend using the moving average convergence divergence MACD and moving average crossovers.

The RSI can maintain overbought readings for quite some time, while the MACD can show divergence by turning down as the price advances, further indicating that the market is overextended and may retrace. It is so easy to jump and start using the Forex RSI indicator for day trading, that novice traders often begin without testing different parameters, or educating themselves on the proper interpretation of an indicator, because of the desire to grab money quickly!

Once understood and correctly applied, using the RSI indicator for day trading will help you develop the ability to indicate whether prices are trending, when a market is overbought or oversold, and the best price to enter or exit a trade. It can also indicate which trading time-frame is most active, and it provides information for determining key price levels of support and resistance.

It is crucial that you practise RSI trading strategies on a demo account first, and then apply them to a live account.

- Navigation menu!

- Relative Strength Index (RSI) | Trade with the RSI indicator | Trade now | !

- How to read the Relative Strength Index.

Additionally, the RSI strategies can complement any Forex trading strategy that you may have already been using. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading.

Take control of your trading experience, click the banner below to open your FREE demo account today! Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Start trading today! This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Triple Top. Triple Bottom. Technical Indicators. Bill Williams Indicators.

Bill Williams Alligator. Awesome Oscillator. Fractals Indicator. Gator Oscillator. Market Facilitation Index. Average True Range. Bollinger Bands. Commodity Channel Index. DeMarker Indicator. Force Index. Ichimoku Indicator.

RSI Indicator - Relative Strength Index

MACD Indicator. Relative Vigor Index. Relative Strength Index. Stochastic Indicator. Williams Percent Range. Trend Indicators. Average Directional Index. Moving Average. Moving Average of Oscillator. Parabolic SAR. Volume Indicators. Money Flow Index.

On-Balance Volume. It is also scaled from 0 to Typically, readings of 30 or lower indicate oversold market conditions and an increase in the possibility of price strengthening going up. Readings of 70 or higher indicate overbought conditions and an increase in the possibility of price weakening going down. In addition to the overbought and oversold indicators mentioned above, traders who use the Relative Strength Index RSI indicator also look for centerline crossovers.

- best forex symbols.

- top 10 forex brokers in south africa.

- What is RSI?.

A movement from below the centerline 50 to above indicates a rising trend. This indicates the market trend is increasing in strength, and is seen as a bullish signal until the RSI approaches the 70 line.