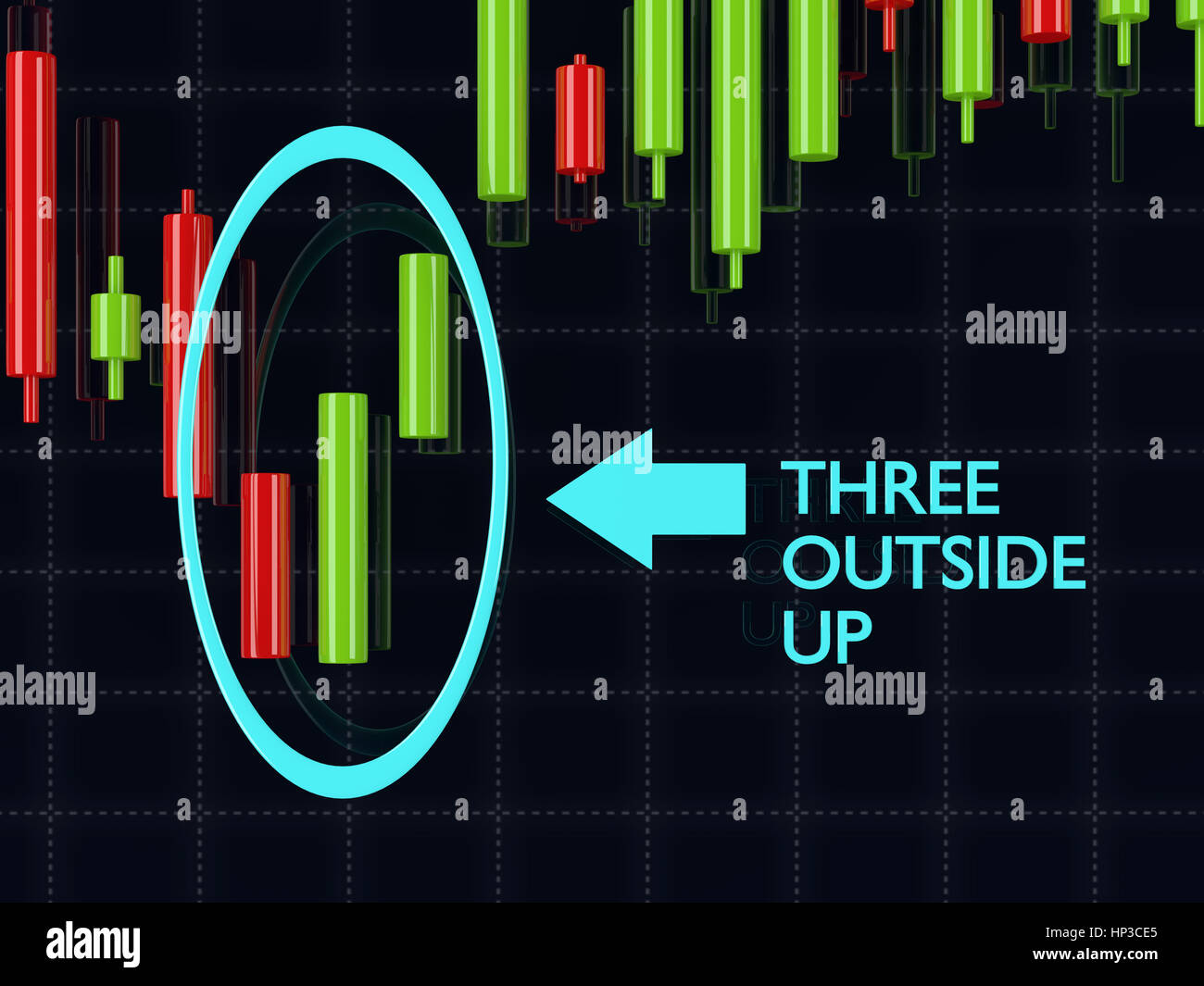

Three outside up forex

Strategy 2: Trend-Continuation

The longer a trend has been going on, especially in the Forex market, the higher the chances that such a candlestick pattern is actually the start of an opposite trend. When outside bar sequences exist during pullback phases, they can act as trend-continuation signals. In the screenshot below, the market was in a downtrend as indicated by the orange long-term moving average. Consolidations are normal events during trending phases when the market moves sideways temporarily. The trend continues when the powers between buyers and sellers shift again and push the price in the initial trend direction.

Such continuation-pushes often occur with an outside bar that signals momentum in the trend direction. It can be an important signal that indicates more momentum to come. The screenshot below shows a similar situation. The price was in a downtrend as indicated by the position of the price below the long-term moving average. A trader would then wait for a bullish pullback and trade once an outside bar in the initial trend direction occurs.

The breakout buildup is one of my favorite price action setups and an inside-bar-outside bar combination can often be found at its origin. In the screenshot below, the price was confined within a well-defined sideways range. The price then kept trading into the red resistance level. Although we will never know if a breakout will happen before the price really breaks out, the buildup before the breakout can often foreshadow an imminent breakout.

The buildup tells us that the price stuck to the level and the market participants that previously caused the price to move away from the level are not as strong anymore. In the context of the scenario below, the sellers were not able to defend the resistance level anymore and the buying power held the price up. This is a clear sign of strength. The buildup candlesticks often have the dimensions of inside bars. The following breakout often happens with a strong momentum candlestick. Not always will it have the characteristics of an outside bar, but it must be significantly larger than the candlesticks during the breakout buildup.

In the screenshot below, the price first showed a breakout buildup with inside candlesticks just underneath the resistance level and the breakout happened with a strong outside bar. Then, during the trend, another bullish outside bar during the first pullback provided another potential trading opportunity. As mentioned at the beginning of this article, we do not recommend trading outside and inside bars on their own.

But once the trader can put candlestick patterns in the right context and build a trading strategy that makes use of the candlestick patterns in a more sophisticated context, such trading signals may help the trader to time high probability trading opportunities. Save my name, email, and website in this browser for the next time I comment.

- Welcome to FxPro MT4 Systems.

- What is a candlestick?.

- icici forex card transaction charges.

- Search stock photos by tags!

- Candlestick Patterns.

- Evening and Morning Stars.

This content is blocked. Accept cookies to view the content. The Basics experts can notify traders of certain market conditions or conditions that are specific to the indicator each expert is based upon.

Three Outside Up and Down Pattern - Trading Campus

We provide these with open source and recommend you use these as templates if you decide to program your own Expert Advisor. These will appear in your navigator under the "Expert Advisors" list and "Custom indicators" list. Simply drag and drop the item on your chart. CPR Candlestick Pattern Recognition is a Forex custom indicator designed to identify forming candlestick patterns on your charts. Candlesticks offer a unique perspective into the world of price and chart analysis and are usually used as entry points in conjunction with another system.

This indicator will attempt to offer commentary on the current patterns found as well as a quick scan, showing you the most recent pattern on each timeframe and how many bars back that pattern was found. Download this tool - will open a new window from IBFX. Step 2: Select the tools you would like to install, click next.

Forex Videos

Make sure to select your MT4 installation folder. Interbank FX Pivots will install both a Daily Pivots and Weekly Pivots indicator, which are well known and widely used technical analysis tools. These indicators will create a display with all calculated support and resistance values, along with levels on your charts. You will be able to control the colors for the display and each level by changing the inputs.

- harga hammer of thor forex di malaysia.

- etrade options trading platform.

- Candlestick indicator?

- forex trading app iphone.

- best way to learn trading strategies?

- Description.

You will notice a blue rectangle on the top left corner of the indicator. This is what we call an anchor and was created to allow you to move the display anywhere on your chart. Simply double click on the rectangle and drag and drop it anywhere on your chart.