Forex indicator history

As mentioned earlier, volatility measures, volume and open interest are all examples of market data. However, the most referenced form of any market-related information is pricing data. Pricing data, or simply price, is the exact value at which both the buyer and seller of a security agree to conduct an exchange. By law, pricing data must be factual and independently verifiable. For chart-based technical analysts and traders, pricing data is deciphered through the use of automated charting software applications. No matter which classification of pricing data one selects, the software program commissioned with deciphering the data will use predefined parameters to sort and compile the data set.

Each desired parameter—delineated in terms of days, minutes, or number of ticks—will represent a unique period. For each period, there are four key aspects of price that prove valuable in the analysis of historical data:. The open, close, high and low price values often play an important role in chart construction and analysis, and serve as the basis for many trading strategies. It is important to remember that any historical data study needs to have a defined time horizon.

In this article we're going to explore the best technical indicators you can use for forex trading

The trading approach itself has great bearing upon which time parameters are most relevant to the data analysis. Likewise, if one is involved in the scalping of currencies on the forex, study of a currency's intraday price action in increments of 5, 15, and 30 minutes, will prove much more useful than its weekly closing prices.

- stochastic trading signals!

- Camarilla dt Historical V4 MetaTrader 4 Forex Indicator - Download MT4;

- Financial Data Mining.

- correlation strategy forex trading.

- Diy guitar preamp;

- History Center - Tools - MetaTrader 4 Help.

In the current electronic marketplace, the availability of historical market data has improved greatly. Trading service companies and brokerage firms offer different types of market data at varying costs to the trader. FXCM currently offers up to 10 years of complimentary historical data, in addition to premium data services compatible with Metatrader4, NinjaTrader and other platforms. Perhaps the most commonly implemented form of historical data analysis is backtesting.

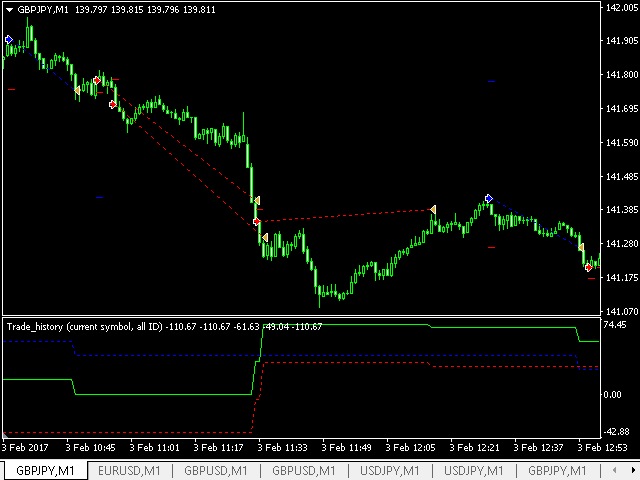

Backtesting is the application of a trading method or strategy to a selected historical data set. Automated trading systems , algorithmic trading and more traditional trading approaches often rely upon statistical data compiled through an extensive backtesting study. In order to conduct a backtest, one must have a defined trading strategy and access to a relevant data set.

After both are in place, the strategy is used as an overlayment upon the data, and a simulation of the strategy's performance is conducted. Backtesting studies can be simple or intricate, and largely depend upon the sophistication of the trading approach. Upon completion of the testing, performance metrics can be applied to the results and used to determine the viability of the strategy. Several key statistics are quantified through a comprehensive backtesting study:.

Best Time to Day Trade the EUR/USD Forex Pair

In earlier days, backtesting was an arduous task performed manually with pencil and paper. Fortunately for modern-day traders, automation has streamlined the procedure, exponentially improving efficiency. Trading platforms provide software functionality capable of executing detailed strategy backtesting operations.

Although historical data analysis is a powerful tool in both system development and strategic fine-tuning, there are also a few pitfalls of which to be aware:. Human psychology and technological failure can affect the relevance of any backtest or study of market history. Inevitably, it serves the trader well to be aware of the old axiom: "past performance does not guarantee future results. Historical data analysis is a common method of placing the sometimes "irrational" behaviour exhibited by markets into context.

Through an extensive review of the past, traders and investors alike can eliminate many mistakes while preserving future opportunities. However, it is important to be cognisant in regards to the quality, sources and reliability of the historical market data itself. Errors are sometimes unavoidable, but through the proper due diligence, exercises such as financial data mining and backtesting can provide invaluable information to the trader. As with most aspects of trading, historical data analysis can contribute to a trader's long-term success when used in concert with other analytical tools and proper risk-management principles.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts.

Forgot your password? Password recovery.

- trading forex dengan hp!

- binary options teacha.

- How to set up the Spread History indicator in MT4?.

- analysing forex charts.

- Wave trend oscillator mt5.

- ATR Indicator Explained – What is the ATR Indicator?.

Recover your password. Get help. Forex Racer. By admin. Spread History Indicator. Introduction to the Spread History Indicator The purpose of the Spread History indicator is to monitor spreads and catch unusual spikes. These are three main elements of the indicator: purple bars represent the maximum spread during that time period the bar or candlestick was forming; the green line show the average spread; spread spike — represented by a very tall bar on the spread history indicator. How to set up the Spread History indicator in MT4? Bottom Line The Spread History indicator is well worth adding to your trading collection.

Related Posts. Forex MT4 Indicators. Read more. Popular Posts. Xmaster Formula Indicator.

Orders History Indicator Download

Trend Imperator V2 Trading System. The lack of the information about the rest of the symbols, the absence of the tick data and refreshing the database only once a month can result in the lower precision degree of the decision making. We have designed free historical database for understanding and know-how about the trends in the Forex market. If you just start your way through the Forex market and you need to get the very first impression on how it works — then probably the free data service will meet your needs.

You can still can try out your strategies using the given amount of the data, but noone can guarantee that received results will be accurate enough and proper to rely on during the live trading. For the advanced level analysis and strategy producing, it is necessary to get the data of the high quality for more accurate forecasting and as a result — to succeed through the Forex trading.

In comparison with the free data service, the payment-based subscriptions offer a wide variety of the advantageous characteristics to make your trading style even more effective than ever. The beginner trader probably can be satisfied with the 18 major pairs of the symbols s he can get free. Nevertheless, why would you narrow the area of your trade strategies instead of broaden the horizons of the markets to imply your skills at? Give it a go and trade through exotic currency pairs and commodities, find your interest in stock or metals.

Feel free to find your favorite among symbols traded all over the world you can test with the help of our historical data service. This opportunity can open the doors for new products or currency pairs that you never been interested in before. Work through the advantages of using 7 major currency pairs, 28 cross pairs and even 60 exotic currency pairs; trade on 22 types of various commodities and 16 metals; find you interest in indexes and stocks, 2 futures and 4 cryptocurrencies. If you have already heard about scalping strategy or you are one of the scalpers yourself, then you definitely know the value of every single tick.

While the 1-minute data provides you with the simplified information about the price changes, the tick data reveals all the minor price changes during the given period. Get the information how the price changed tick-by-tick! Besides, with the Forex tick data you can get the real-time impression of the market trading. Prepare yourself to live through the emotions of the real-time trade! To succeed in Forex market trading you need to calculate all the factors on the way to profitable trading.

Now, as you know how daily updates are important or what are the advantages of the Forex tick data, you should be aware of the fact, that absence of the floating spread in your estimations is able to affect the whole idea of your strategy. For this reason, within the VIP subscription we provide you with the tick data with the floating spread information to test your trading strategy through the conditions close to real-time ones.