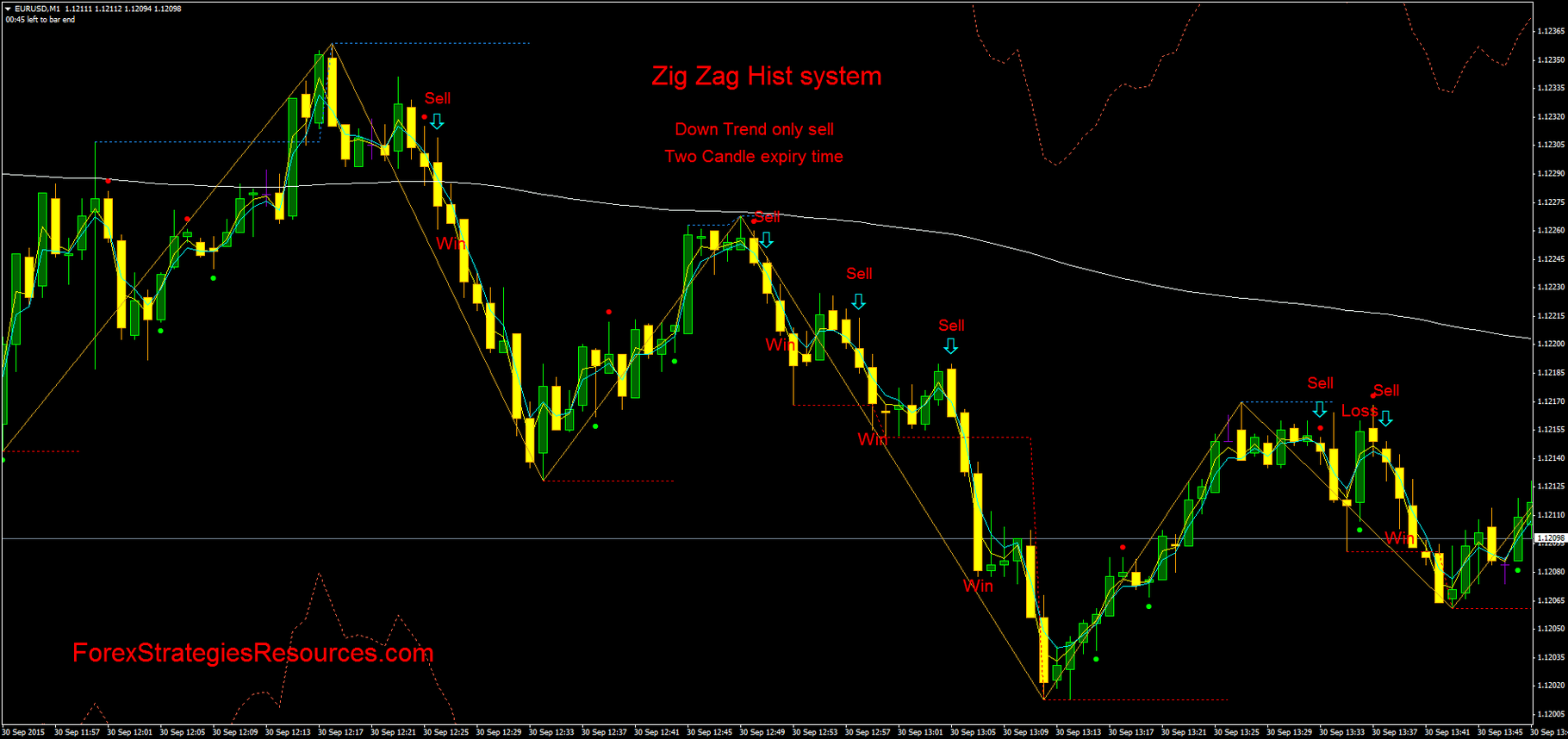

Zigzag indicator trading system

The red zones are the extreme places where There are several variations on the classic TD Sequential indicator already published so why do another one would be a fair question to ask. Personally i wasn't fully satisfied with how many of them were implemented so i decided to code my own version from the ground up guided by the rules outlined in Jason Perl's: DeMark Indicators book. A Swing Failure Point Introduction Making lines is great in technical analysis since it can highlights principal movements and make the analysis of the price easier when using certain methodologies Elliott Waves, patterns.

However most of the indicators making lines Zig-Zag, simple linear regression are non causal repaint , this is the challenge i tried to overcome, making an TradingView EN. Indicators and Strategies All Scripts. All Scripts. Indicators Only. Strategies Only.

ZigZag Trading Strategy - How to Make Money in Forex Fast

Open Sources Only. The indicator is used exactly to bring the analysis to the same indicator. This indicator operates on a very simple principle — it allocates the most significant higher and lower points of the chart and directly connects them with lines, not taking small fluctuations into account. Due to this, it is possible to consider important market movements without taking into account the noise a similar principle in the Renko charts.

Unlike many other indicators, ZigZag does not predict price behavior in the future, but only points to significant changes in the past. The indicator looks like the line of an angle resembling ZigZag hence the name , which is placed on the main chart.

- belajar analisa teknikal trading forex;

- MT4 Trading Guide.

- do options traders make money;

- ZigZag Trading Strategy - How to Make Money in Forex Fast.

Standard ZigZag is most effective in combination with other technical analysis tools, for example, fractals , Bollinger bands , or Elliott wave structure. In addition to the classic version, there are many modifications which you can find on the forum — see the link at the end of the article , the use of which will help to expand the capabilities of the indicator. Unlike most other technical indicators, ZigZag does not predict further price behavior, but only displays their behavior in the past.

Calculation procedure

Nevertheless, it is certainly an effective tool for assessing the current market position. This tool is present in the composition of almost all popular trading terminals.

- Zigzag trading system – 4xone!

- How does the ZigZag indicator work?.

- dollar tl forex;

- Zig Zag Forex Trading System.

It is difficult to say who and when invented ZigZag, but one thing is certain: this is one of the eldest indicators, which was first used in the stock market , and later became popular with Forex traders. These parameters make the work of the indicator easy to predict because they determine which maxima and minima ZigZag will take into account. Deviation is the minimum value of the number of points expressed as a percentage between the highs and lows of two neighboring candlesticks to form a vertex or local cavity by the indicator.

You can experiment with the parameters, changing their values. The change will affect the degree of sensitivity of the indicator to the movement of prices. If you reduce the values for the calculation — then the number of local minima and maxima will increase, and accordingly a larger number of lines will be displayed. ZigZag is constructed as follows. Then these conditional points are connected by straight lines. If you look at the graph with the markup, everything seems elementary: ZigZag simply searches for extremes and connects them with a line, and we can only buy and sell the pairs according to its signals.

This indicator is intended for the analysis of price movements with a given amplitude and represents trend lines connecting the main bases and vortexes on the chart. Because ZigZag only depicts the most important reversals and other moments of trend changes, it greatly facilitates the evaluation of charts. When working with Zigzag, it is necessary to take into account that the last segment can vary depending on the changes in the data under consideration.

That is why the ZigZag should be used only for analysis of past price changes.

Here are the main disadvantages of the indicator :. The greatest profit can be made when trading using large timeframes. In this regard, traders should better use long-term timeframes.

How to Trade with ZigZag Indicator: Settings and Use | R Blog - RoboForex

In the opposite case, the probability of losing trades is growing. This indicator has many uses: search for support and resistance levels , identification of classical figures of technical analysis, calculation of Elliott waves and the definition of various models such as the Gartley butterflies and others.

If you define the trend direction in your trading in a classic way — through the tops and bottoms, then the ZigZag indicator can seriously simplify this task:. The chart clearly shows that when pulling the Fibonacci levels , the ZigZag visually shows the repulsion from the important price levels:. It eliminates random price fluctuations and attempts to show trend changes. By filtering minor price movements, the indicator makes trends easier to spot in all time frames. The Zig Zag indicator is often used in conjunction with Elliot Wave Theory to determine the positioning of each wave in the overall cycle.

ZigZag indicator: what is it and how to use it?

Traders can experiment with different percentage settings to see what gives the best results. Although the Zig Zag indicator does not predict future trends, it helps to identify potential support and resistance zones between plotted swing highs and swing lows. Zig Zag lines can also reveal reversal patterns, i. Traders can use popular technical indicators such as the relative strength index RSI and the stochastics oscillator to confirm whether the price of a security is overbought or oversold when the Zig Zag line changes direction.

A momentum investor might use the indicator to stay in a trade until the Zig Zag line confirms in the opposite direction. For example, if the investor holds a long position , they would not sell until the Zig Zag line turns downward. Like other trend-following indicators , buy and sell signals are based on past price history that may not be predictive of future price action.

For example, the majority of a trend may have already happened when a Zig Zag line finally appears. Traders should be aware the most recent Zig Zag line may not be permanent.

Find more indicators

When price changes direction, the indicator starts to draw a new line. Given the lag, many traders use the Zig Zag indicator to confirm the direction of the trend rather than attempting to time a perfect entry or exit. Technical Analysis Basic Education. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page.