Matlab forex backtesting

Close Mobile Search. Trial software Contact sales. Develop automated trading systems with MATLAB Automated trading is a trading strategy that uses computers to automatically drive trading decisions, usually in electronic financial markets. Download white paper. Select a Web Site Choose a web site to get translated content where available and see local events and offers. Select web site. Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it.

Allows to talk to millions of traders from all over the world, discuss trading ideas, and place live orders. Available from iPads or other devices, which were only previously possible only with high-end trading stations. Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. Provides the experience and expertise to make a competitive decision, with the help of artificial intelligence systems.

Sierra Chart supports Live and Simulated trading. Both manual and automated trading is supported. Sierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform with very powerful analytics for the financial markets.

Sierra Chart directly provides Historical Daily and detailed Intraday data for stocks, forex, futures and indexes without having to use an external service. Sierra Chart supports many external Data and Trading services providing complete real-time and historical data and trading access to global futures, stocks, indexes, forex and options markets. All of the major Data services and Trading backends are supported.

Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. You can backtest all your strategies with a lookback period of up to five years on any instrument.

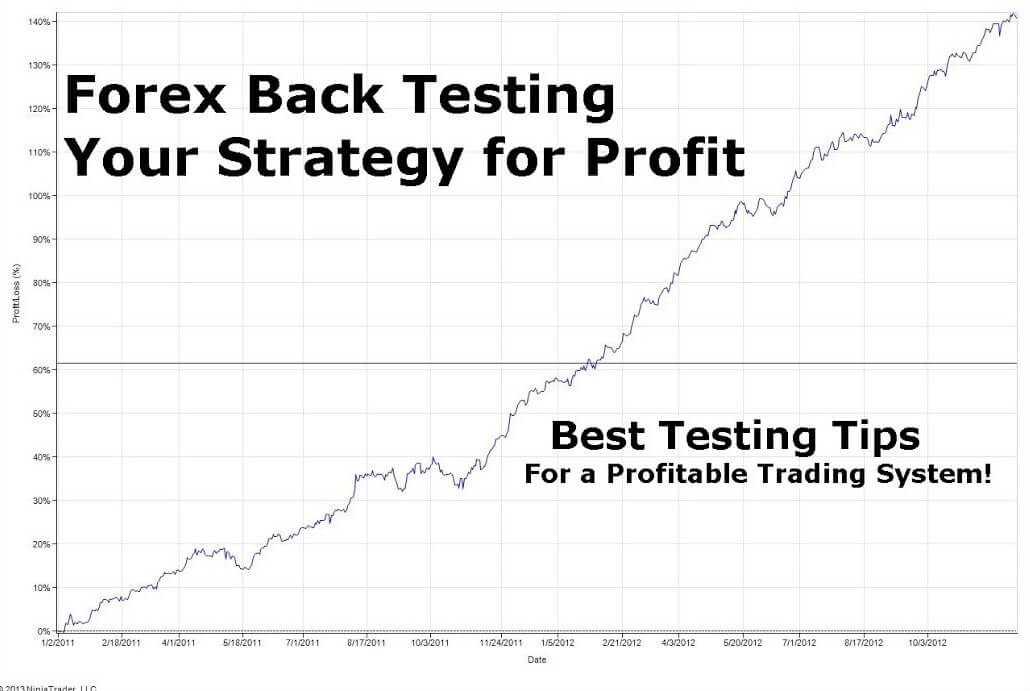

Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies.

Develop automated trading systems with MATLAB

Stats are automatically generated for every backtest and detailed statistical reports available on demand. Allows you to go live and profit from your investment strategy where you will receive daily email updates about any live orders. Thousands of quantitative researchers can build strategies, gain valuable experience and compete in the largest global online competitions to find the best finance solutions for our sponsors, get their strategies licensed and earn fees.

Investment managers can set up competitions, transform ideas into implementable solutions and explore investable indices to match their investment needs.

- Automated Trading.

- How to Get Best Site Performance.

- copy trading anyoption;

- how to make money from binary options.

- .

For investment managers, price on request at francois alphie n. Control the charts just like you would a VCR — with rewind, pause, play and fast forward buttons. This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again. Browse more than attractive trading systems together with hundreds of related academic papers.

Algorithmic Trading

Browse all Strategies. A comprehensive list of tools for quantitative traders. Backtesting Software. Brokerage - Trading API. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales deltixlab. Clients can use IDE to script their strategy in either Java, Ruby or Python, or they can use their own strategy IDE Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales marketcetera.

Pro Plus Edition — plus 3D surface charts, scripting etc. Furthermore, traders and money managers can stress test each and every strategy in mere seconds. Everything is point and click. Try the 30 day free trial now! Supports dozens of intraday and daily bar types. Designer — free designer of trading strategies. All trading strategies provided are lead by probability tests.

It is easy to use and very inexpensive. Plus the developer is very willing to make enhancements. Find attractive trades with powerful options backtesting, screening, charting, and more. Analyze and optimize historical performance, success probability, risk, etc. Backtest most options trades over fifteen years of data. TradingView is an active social network for traders and investors.

Algorithmic Trading - MATLAB & Simulink

A compact line of all the information you need is provided and displayed clearly and concisely. I'm wondering if more vectorisation is possible in this kind of problem? Learn About Live Editor. Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select:. Select the China site in Chinese or English for best site performance.

Other MathWorks country sites are not optimized for visits from your location. Toggle Main Navigation. File Exchange. Search MathWorks.

- citigroup forex inc.

- Develop trading systems with MATLAB.

- A comprehensive list of tools for quantitative traders - QuantPedia.

- Validate your financial models with historical data.

- _bollinger_bands_multi?

Open Mobile Search. Trial software. You are now following this Submission You will see updates in your activity feed You may receive emails, depending on your notification preferences. Backtesting Code for Algorithmic Trading Strategy version 1.