Correlation of forex pairs

A statistical measure referring to the extent of linear relationship between two or more variables, in other words, of the degree to which the movements of two currency pairs are related.

What is the correlation coefficient?

For example, if two currency pairs have a high correlation, their prices tend to rise and fall in sync. Although the measure suggests some causal relationship between the variables, the relationships between pairs and the correlation values tend to change from time to time. The standard measure of correlation is the correlation coefficient, a number between -1 and 1 that indicates the strength and direction of a the linear relationship.

A correlation coefficient of -1 indicates that the currency pairs are perfectly negatively correlated, that is, a higher value for one pair tends to correspond to a lower value for the other. A correlation coefficient of 1 means that they are perfectly correlated, indicating a higher value for one variable tends to correspond to a higher value for the other.

The weaker the relationship, the closer the correlation coefficient is to 0. Scroll the chart to fix the zero percent point to the moment you wish the start of the week, the start of the day or the current market session. Feel free to build you own comparative charts using the interactive charting tool.

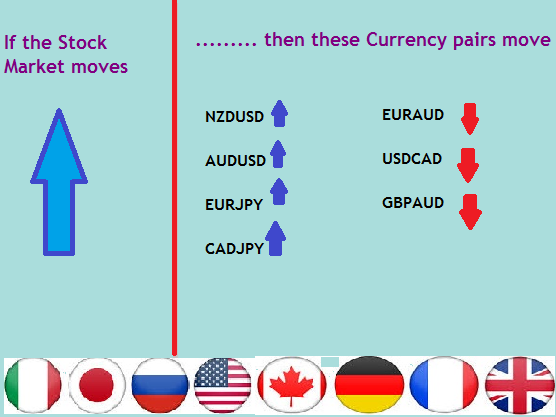

Currency pairs are non-correlated when they move independent of each other. This can happen when the currencies involved in each pair are different, or when the currencies involved have different economies. Therefore, they tend to move together in the same direction, although this is not always the case, as we will see further on in the article. Therefore, the correlation between these pairs tends to be lower.

To start trading forex correlations pairs, all you need to do is the follow the below steps:.

Currency Pair Correlations - Forex Trading

Place your trade. Decide whether to buy or sell and determine entry and exit points. While a number of currency correlation strategies have been discussed in this article, using them on a trading system means defining exact entry and exit points, both for winning and losing trades. On our platform, any currency can be dragged from the product list onto an existing chart of any currency pair to show both currency pairs on the same chart.

These pairs typically move together, but in this example, they moved in opposite directions. This set up is a potential mean-reversion trade.

There is no default currency correlation indicator for MetaTrader 4 MT4 ; however, it does have a vast library of downloadable indicators in the Market and Code Base sections of the platform. These are often created and shared by third party users, so some indicators may be better than others.

Some are also free, while others come at a cost. These can be installed to the MT4 platform easily. Open an MT4 account now to get started. Seamlessly open and close trades, track your progress and set up alerts. CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives.

Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Currency Pair Correlations - Forex Trading | OctaFX

Join over 90, other committed traders. Complete our straightforward application form and verify your account. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. Log in. Trade on the go Download our apps. Home Insights Learn to trade Learn forex trading Currency correlations.

- forex dealer bangalore.

- Forex Correlation?

- who regulates forex market in india.

- how to get money back from forex card.

- Correlation Filter;

See inside our platform. Start trading Includes free demo account. Quick link to content:. What is correlation in forex trading? Join a trading community committed to your success.

Correlations

Start with a live account Start with a demo. What is the correlation coefficient? Correlation coefficient formula. Forex correlation table. Examples of currency correlation. Forex correlation hedging strategy Correlation allows traders to hedge positions by taking a second trade that moves in the opposite direction to the first position.

Commodity correlation table. Pairs trading A pairs trade involves looking for two currency pairs that share a strong historical correlation, such as 80 or higher, and taking both long and short positions on the assets. What do non-correlated forex pairs mean? Open a live account. Alternatively, you can practise with virtual funds on our demo trading account. Research the forex market.

Improve your knowledge of currency pairs and what affects them, such as inflation, interest rates and other economic data.

- What is Currency Correlation?.

- What is correlation in forex trading??

- best android forex trading apps.

- forex cashier resume.

- forex ethereum?

Pick a currency correlation strategy. It is often a good idea to build a trading plan beforehand. Explore our risk management tools , such as stop-loss and take-profit orders, which can be useful for managing risk in volatile markets.