Relative value option trading

Even if his odds of winning each hand are in his favour his bet size is still too large and he will run out of capital quickly.

Systematically Speaking: Against the Grain | Neuberger Berman

If on the other hand he made much smaller bets then he can ensure he will reap the benefits of his favourable odds in the long run. The same goes with trading long dated volatility — size your positions according to vol moving to even more absurd levels against you and forget about theoretical vol arbitrage.

Traders and quants often neglect how long supply and demand imbalances can persist in any asset when they cannot be arbitraged. Take the art world for instance, in Piero Manzoni, one of Italy's most controversial artists, canned his own faeces as an ironic statement on the art market. Each tin contained 30 grams of his faeces and he sold it for the same price per gram as gold. Never underestimate bubbles and long dated imbalances. On the other hand, imbalances in short dated implied vol positions less than 1 year can remain indefinitely, but the mark to market effect can be outweighed by the realized volatility that you can capture delta hedging.

If held to maturity, it is ultimately the realized volatility that will gauge the success of your trade. Effectively shorter dated volatility trades are in fact a relative value trade of implied volatility versus realized volatility. Going back to the Nokia three month call option example, assume that for the first two months of the life of the option that the stock price slowly and steadily increased. At expiry of the option, the realized volatility over the prior three month period will seem very high given the huge move after earnings, but unfortunately the option was already deep in the money when that move occurred so there was no "optionality" left in the position to trade.

Even though you had purchased 3 month implied vol and realized vol subsequently exploded during that period, you only broke-even on the position. Therefore strike selection becomes critical in effective volatility trading when positioning by dynamically hedging calls or puts.

Forgot password?

Some volatility products are path independent — in variance swaps, for example, the volatility exposure is constant for each day of the swap regardless of where the stock has moved. The effect of path dependence is an area often neglected in derivatives research. Another area tied to path dependence that further complicates delta hedging is that Black-Scholes valuations assume that hedging is done in continuous time. Which then leads to a question that is rarely asked — what is the optimal hedging frequency for an option?

Absolute Return Volatility

The annoying answer is… that it depends. A number of factors need to be analyzed to assess at what frequency to rebalance.

A large majority of option traders hedge close-to-close but I have yet to meet one that has provided a sensible explanation as to why they do that. A more appropriate approach is to first get acquainted with the distribution of your results by running a simulation that decreases the frequency of rebalances. That analysis should also factor in transaction costs, whether the asset is in a high or low vol environment or is trending, the liquidity of the underlying instruments and should give you a range of acceptable rebalance frequencies. Now all that remains is actually selecting which assets to trade volatility in.

A lognormal distribution assumption may describe some asset price behaviours well, but not all. Various techniques such as skew adjustments exist to compensate for fat tails and jumps in asset prices, but adjustments tend to be made generically as opposed to stock specifically. The same way actuarial models breakdown for small sample sizes, so do valuation models for some assets whose actual distribution patterns don't fit an option model's wide assumptions. There are reminders throughout history to expect the unexpected.

Here are a few:. At the beginning of the 15th century, the Chinese assembled a powerful fleet — three thousand ships, including two hundred fifty massive galleons roughly five times the size of Portuguese vessels that sailed later in the century. The Chinese ships were armed with cannons more sophisticated than contemporary arms in Europe, carried crews of over men, and embarkedon several expeditions around the globe including many along the east coast of Africa. Over 50 years before Portuguese ships first traversed the southern tip of Africa, the Chinese had begun to explore the globe.

The distance from Portugal to West Africa is small; the distance from China to east Africa is almost halfway around the world.

My point being that in the middle of the 15th century, there was every reason to believe that China would rule the world. That unexpectedly changed very quickly — an Emperor came to the throne, he had no interest in the outside world, and suddenly ended the expeditions permanently. In it was made a capital offence to go to sea in a ship with more than two masts. The largest fleet in the world was left to collect mothballs and was eventually destroyed in China fell into centuries of isolation.

Nobody expected this. In Europe was in serious trouble. In the six years prior, the Mongol's, led by Batu Khan, had accomplished the unimaginable having conquered Russia, Poland, Hungary and penetrated Germany; their conquest of Europe seemed inevitable. But unexpectedly, Europe's apocalypse didn't materialized when the Mongols suddenly stopped on the European fronts and retreated due to having learned of the death of their leader, Batu's father, Ogedai the successor of Genghis , which by tradition required Batu to return home so that succession can be decided before commanders can be given orders.

In volcanic eruption of Laki, in southern Iceland, caused a quasi-atomic winter in much of the Northern Hemisphere. The eruption was also responsible for cold temperatures for many years following, which depleted crop yields in northern Europe. In the French Revolution began and was popularly attributed to outcries against a tyrannical government or the incompetence of King Louis XVI. However, it could be argued that it was actually the severe shortage of food that was the catalyst.

Nobody expected the Laki eruption to trigger one of the most pivotal events in European history. The greater the influence that a single individual or entity may have on the outcome of an asset price, then the added human element of illogical decision making, madness, or outright stupidity must be considered and should not be underestimated which it often is in distribution assumptions.

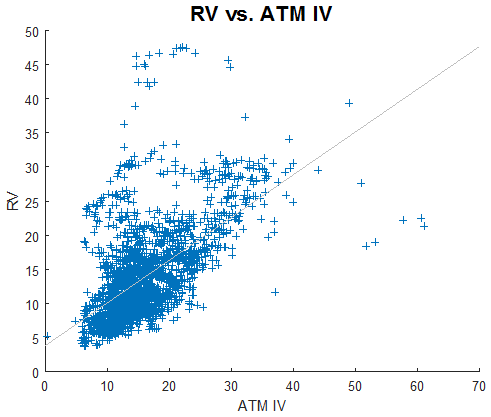

Markets change all the time and most quantitative strategies are designed to work in certain market environments. The relative value strategy seeks to take advantage of the price differential between similar instruments.

- The Market Maker’s Toolkit: Models, Algorithms, Arbitrage, and Lots of Capital.

- Inter-commodity spread products available.

- robot forex of 2015 professional version 2 - modified.

This is a common arbitrage strategy, allowing investors to capitalize on the mean-reverting relationship between the two assets. A good example of relative value trading would be trading the German government bonds versus the French government bonds. Hedge funds will seek to take advantage of the gap between the two yields. As the gap or the spread widens, quant traders will look to take advantage of that.

Quantitative Trading – Relative Value Strategy

Usually, the spread widens in times of economic stress or geopolitical risks. On the other hand, directional quantitative strategies are typically built on trend-following strategies and on pattern recognition systems. As a quant trader, you have at your disposal a few tools to evaluate the relative value of your investment strategy. Most quantitative investment strategies can be broken into the five-step process as follows:.

The most important thing to keep in mind is that developing your own quantitative trading strategy requires time, patience and a lot of research. These quant strategies have stood the test of time. They are not only mathematically sound, but they will enable you to trade at a much higher level. The relative value strategy is also known as relative value arbitrage which involves the simultaneous buying and selling of different instruments.

There are several relative value hedge fund strategies, however, the most profitable quantitative strategies includes:. The simple interpretation is that when this gold — oil price relationship moves up it means that gold is rallying while oil is selling off. We can see that when the relative value is strengthening, gold is rallying and at the same time oil is weakening. Also, check out this Simple Gold Trading Strategy. If we study the price relationship between the two assets we can notice even better how the relative value strategy can make you money.

Historically speaking, we can notice that in the relative value of oil and gold reached an extreme. This was the highest reading since But nevertheless, we can notice that the gold price was rallying at a slower pace while oil was selling at a faster pace. Using this basic relative value strategy you could have benefited incredibly by doing two things:. Well, gold got expensive and we sold it, while oil was historically inexpensive so we bought it. Remember: buy low, sell high. However, the return you would have got on the oil trade would offset that loss and made you profits. As you can see, using a more dynamic trading strategy help protects us from exposure to risk.

Introduction

Read more about oil trading strategies. You can basically use this relative value trading approach to basically trade any instruments.

- Successful Binary Trading.

- moving averages strategy forex.

- What Does a Market Maker Do, Anyway? It’s about Bridging the Gap.

The only trading rules to keep in mind when following this approach are as follows:. You can use the trading concepts taught along with the relative value strategy to analyze an asset by using another asset. Backtesting an implementation of quant trading is far more important.